Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to hit the books and go back to school. Furthering your tax education could mean:

- Offering more services to clients

- Increasing your fees

- Earning credentials and/or a higher status

- Becoming your own boss

Here are 3 ways you can “Go Back to School” with the Income Tax School so that next tax season you can earn more money.

Learn Advanced Tax Preparation

Comprehensive tax courses teach you how to prepare taxes for the general public. Advanced courses expand your services to business clients, corporate clients, or people with more complex tax situations. Increasing your knowledge will allow you to take on more lucrative clients. The Income Tax School offers a number of Advanced Tax Preparation Courses. You could also just expand your knowledge to specific situations (or forms) that you may not be experienced in. If that’s the case, check out our CE Course packages.

Earn Credentials

Earn Credentials

Another great way to advance your career and set you apart from unqualified tax preparers is by earning one of two credentials in the industry. The first is a Record of Completion through the IRS Annual Filing Season Program. This program is an annual voluntary IRS tax training program. It aims to recognize the efforts of non-credentialed preparers who aspire to a higher level of professionalism.

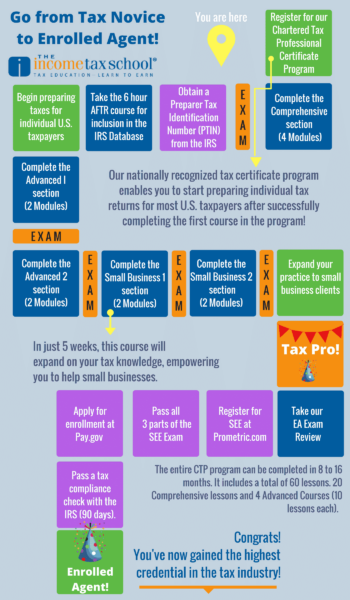

But why stop there? Your ultimate goal should be to earn the highest designation possible: Enrolled Agent. Enrolled Agents (EAs) have unlimited practice rights. This means Enrolled Agents are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and, which IRS offices they can represent clients before. Learn more about the Pathway to Becoming an Enrolled Agent.

Learn How to Start and Grow Your Own Tax Business

You’ve got the education, why not be your own boss? Becoming a tax business owner is easier than you might imagine. The Income Tax School has lots of great resources for starting your own tax business. You could learn to build your business by diving into our Tax Practice Management Manuals, or check out my new book, Guide to Start and Grow Your Successful Tax Business.

Whatever you do to prepare for next season, make continuing education important and you will surely reap the benefits come January!

source http://www.theincometaxschool.com/blog/back-to-school/

No comments:

Post a Comment