Thursday, August 31, 2017

Introducing: Guide to Start and Grow Your Successful Tax Business

I’m excited to announce the release of my book, Guide to Start and Grow Your Successful Tax Business! This 289-page book is a go-to guide for anyone looking to start or grow a tax business. The guide covers everything from learning tax preparation, to establishing your tax office, marketing and pricing, recruiting and training employees, dealing with the IRS, and so much more!

I have spent much of my career helping others become independent tax professionals and have helped  guide many to start their own tax businesses. One very important thing I’ve learned over the years is that there is no need to reinvent the wheel. This book is a practical, comprehensive guide that is beneficial for all entrepreneurs planning to operate as either a sole-tax practitioner or a tax business owner employing other tax preparers. Throughout this book, you will learn many best practices that will save you time and money, and help you grow a successful tax business.

guide many to start their own tax businesses. One very important thing I’ve learned over the years is that there is no need to reinvent the wheel. This book is a practical, comprehensive guide that is beneficial for all entrepreneurs planning to operate as either a sole-tax practitioner or a tax business owner employing other tax preparers. Throughout this book, you will learn many best practices that will save you time and money, and help you grow a successful tax business.

I am honored to have the foreword of my book written by Roger Russell, Senior Editor for Accounting Today. According to Roger, “It is destined to become the bible for the tax preparation business.”

Testimonials

I would also like to thank Ce Ce Morken, Roger K. Burgess, and Nathaniel R. Causley for taking time to read and provide testimonials for my book.

“We know from talking to our customers how important it is for a tax professional to feel like a trusted advisor to their clients. This book has all the elements to set you up for success and to be that advisor from developing a business plan to diversifying for year-round revenue. We’ve worked with ITS on several projects their rich domain access is unequalled and Chuck’s breadth and depth of knowledge really shine through. His passion to help tax professionals grow and prosper equals our own and is inspiring.” – Ce Ce Morken, General Manager of Intuit ProConnect Group

“The Income Tax School invests significantly to ensure the very best curriculum development and content delivery. Feedback from participants has been excellent and truly supports The Income Tax School’s position that it sets the standard for tax preparer training and enabling ITS graduates to start successful independent tax businesses.” – Roger K. Burgess, former IRS Deputy Asst. Commissioner and District Director

“Reading the start-up business guide book has been a transforming experience to my business life. In 2015, after spending 10 years as a District General Manager with a national tax firm, I started up my own tax business, Global Tax Centers. Using The Income Tax School Tax Practice Manual as my guide, I grew from a one-man operation to 22 home-based Affiliate/Owners across the US. The ITS tax business operating principles are as sound as Mt. Everest and explained with great clarity for easy retention. Chuck McCabe’s insight into the tax industry is priceless, and provocative, and his manuals are required reading for every one of our Affiliate/Owners. Every person looking to start their own tax business could benefit from reading these manuals.” – Nathaniel R. Causley, Jr., J.D., Founder, President & CEO, Global Tax Centers

At The Income Tax School, our mission is to empower people with a professional career to fulfill their dreams and serve others as industry leaders.

This book will help us fulfill our mission by enabling you to succeed as a tax entrepreneur! Whether you are a sole practitioner or a tax business owner employing others, this book will provide many best practices to save you time and money, and help you grow a successful tax business.

The book can be purchased on our website here: Guide to Start and Grow Your Successful Tax Business

source http://www.theincometaxschool.com/blog/guide-start-grow-your-successful-tax-business/

Wednesday, August 30, 2017

Tuesday, August 29, 2017

Monday, August 28, 2017

Sunday, August 27, 2017

Saturday, August 26, 2017

Friday, August 25, 2017

Thursday, August 24, 2017

Wednesday, August 23, 2017

The Benefits of Guest Blogging

Content marketing has become an important part of marketing for every business. Beyond sharing your expertise on your blog or creating white papers for download, there’s another great option – that could help get you in front of fresh eyeballs. It’s called guest blogging. Guest blogging is just what it sounds like. Creating original content for someone else’s website or blog.

The Benefits of Guest Blogging

Guest blogging can be a great way to extend your reach and get your name or business in front of a different audience. It also has the following advantages:

- Shows off your expertise

- Offers insight into your industry that another audience may not have been aware of

- Allows you to link back to your website (this can help increase your SEO)

- Is a way to promote your business and services

- Adds credibility to your voice, and can be used as a promotional tool (as seen on X website)

Who to Reach Out To

Guest blogging is great, but you don’t want to just write for anybody. The partnership should benefit both you and the blog you’re writing for. Look for websites and blogs with high readership – the last thing you want to do is spend time crafting a blog post that no one will see. You should also make sure that the information you offer would be of value to the readers in the publication. Here are some ideas:

- Blogs or websites that cover the tax industry

- Companies in your area that offer complimentary services (banks, financial institutions, etc.)

- Local business associations

- Major online publications that cover tax topics

- Local news publications

- Organizations whose members could benefit from tax tips

What You Should Write About

Think about the audience and what they would find valuable. Overall, topics should offer insight and advice that readers could learn from or use in their own situations.

- Tax industry news that might affect them.

- Tax tips

- Bookkeeping and payroll tips

- Tips on choosing the right tax preparer

Now is the time to start researching possible places to guest blog. Reach out with an email, introduce yourself, and offer up some topics and a timeline. If they have an editorial calendar, they’ll appreciate the early planning and you may just land on their calendar. If not, just reaching out and building the relationship is a great first step.

Speaking of guest blogging… we often get emails from other businesses who are looking to guest blog. If you’re interested in doing a guest blog post on our Tax Talk blog, download our guidelines:

Guidelines for ITS Guest Blogs

source http://www.theincometaxschool.com/blog/guest-blogging-tax-preparers/

Tuesday, August 22, 2017

Monday, August 21, 2017

Sunday, August 20, 2017

Saturday, August 19, 2017

Friday, August 18, 2017

New Guidelines On Passwords

You know all that advice about making hard passwords? They must include at least one number and/or specialcharacter? You know how we’re told to change the password frequently and to never use the same one for different things?

Well there are new guidelines that basically say forget what you’ve been told. So, thanks to the National Institute of Standards and Technology, managing your passwords is about to get easier!

Paul Grassi, senior standards and technology adviser at NIST told NPR, “The traditional guidance is actually producing passwords that are easy for bad guys and hard for legitimate users.”

Here are some highlights on the new guidelines:

- Keep passwords simple, long, and memorable.

- Use phrases, lowercase letters, and typical English words.

- There’s no need for special characters or a mix of upper and lowercase letters.

- There’s no need for your password to expire.

That’s it! Easy peasy! You can read the full report here: NIST Special Publication 800-63B

You can also hear (and read) the full interview with Paul Grassi on NPR’s All Things Considered.

source http://www.theincometaxschool.com/blog/new-guidelines-passwords/

Thursday, August 17, 2017

Wednesday, August 16, 2017

Tuesday, August 15, 2017

Shopping trends and taxes

I remember when the US Census Bureau first started reporting retail sales for e-commerce in the 1990s and it was less than 1%. They just updated data for 2015 and report that e-commerce retail sales represent 7.2% of total sales for 2015 (it was 6.4% in 2014). That doesn't seem like a lot to me. In contrast, the US Census Bureau reports that for 2015, e-commerce sales of merchant wholesalers represented 30.2% of total sales (it was 28.1% in 2014).

Are retail e-commerce sales going to increase to the point were 25% of US malls will close in the next five years? Seems high to me. I expect re-purposing where, perhaps, we might do more online shopping while at the mall looking at samples of what we can buy, and getting a latte and recharging our smartphones. That would use less retail space. Malls might add more ways for people to hang out - activities, fairs, etc.

Tax implications? A few:

- More online shopping can mean more uncollected use tax although I suspect a lot of the e-commerce growth will be with Amazon that collects tax in all states (at least on their direct sales).

- If malls turn into abandoned buildings or vacant lots, property taxes will go down. Is there another need for them? With an aging population, perhaps the space gets turned into living spaces for older folks - single level, close to public transportation and medical facilities, etc.

source http://21stcenturytaxation.blogspot.com/2017/08/shopping-trends-and-taxes.html

Monday, August 14, 2017

Sunday, August 13, 2017

Saturday, August 12, 2017

Friday, August 11, 2017

Thursday, August 10, 2017

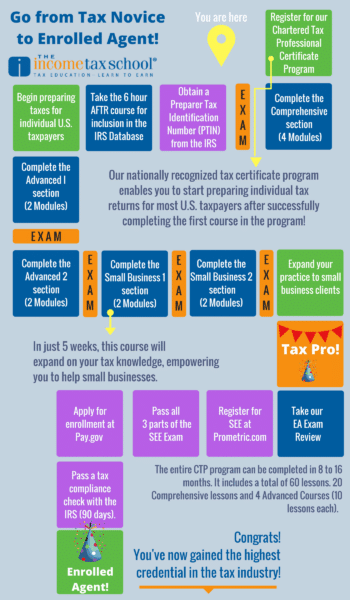

The Path to Enrolled Agent

If you’re looking for a career in the tax industry, set your sights high! While it doesn’t take much to become a tax preparer and start preparing taxes for the general public, earning a credential as an Enrolled Agent should be the ultimate goal.

Enrolled Agents are the only credentialed tax preparer and thus have instant credibility, they also have unlimited representation rights and the knowledge to prepare complicated tax returns (thus they earn more money).

Benefits of Becoming an Enrolled Agent

While it may seem like a long road, becoming an Enrolled Agent is an attainable goal that can easily be tackled with the help of The Income Tax School. Our nationally recognized Chartered Tax Professional Certificate Program will not only provide you with the education you need to prepare taxes, you’ll learn everything you need to know to pass the IRS EA Exam. Here’s a guide to your path as an EA.

Step 1: Register for our Chartered Tax Professional Certificate Program

Our Chartered Tax Professional Certificate program can be taken completely online. It includes a total of 60 lessons: 20 comprehensive lessons and 4 advanced courses (10 lessons each).

Step 2: Complete the Comprehensive Section

Once you’ve completed the 4 module comprehensive section, you will have the knowledge you need to start preparing individual tax returns for most U.S. taxpayers.

Step 3: Obtain a Preparer Tax Identification Number (PTIN) from the IRS

In order to prepare taxes for compensation, the IRS requires that you register with them and obtain a PTIN.

PTIN Requirements for Tax Return Preparers

Step 4: Take the 6 Hour AFTR Course

The IRS Annual Filing Season Program (AFSP) is an annual voluntary IRS tax training program for return preparers. It aims to recognize the efforts of non-credentialed return preparers who aspire to a higher level of professionalism. Those who pass earn a Record of Completion, are given limited representation rights, and are listed on the IRS Federal Tax Return Preparers Directory. This list is being marketed to taxpayers through a public education campaign that encourages taxpayers to select return preparers carefully and seek those with professional credentials or other select qualifications.

IRS Annual Filing Season Program (AFSP)

Step 5: Begin Preparing Taxes for Individual U.S. Taxpayers

You’re officially capable of preparing taxes for the general public! Seek employment with a tax firm in town or go out on your own!

Step 6: Continue Your Education

Keep working your way through our CTP course. You’ll take the Advanced 1 and Advanced 2 sections to learn how to prepare more complicated tax returns. Next, you’ll tackle the Small Business 1 and Small Business 2 and learn to help small businesses with their taxes.

Step 7: You’re a Tax Pro!

Once all courses are completed, you will have the knowledge you need to prepare taxes for anyone – and to start preparing for the EA Exam (called the Special Enrollment Examination). The entire CTP program can be completed in 8-16 months. As you work through the program, you can gain experience as a tax preparer. Once you’ve completed the program, you will receive a certificate from The Income Tax School that can be framed and displayed on the wall in your office.

Step 8: Take Our EA Exam Review

The Income Tax School offers an EA Exam Review through a partnership with ExamMatrix. ExamMatrix’s groundbreaking EA Exam Review Software has completely changed the landscape of EA Exam Review preparation. They offer an “Adaptive Learning” technology where students experience a personalized study program that accommodates your busy schedule.

Here are some study tips: How to Study for the Enrolled Agents Exam

Step 9: Register for and Take the SEE

Register for the SEE at Prometric.com. You will need to create an account and then schedule your exam.

There are three parts to this exam:

- Part 1 – Individuals

- Part 2 – Businesses

- Part 3 – Representation, Practices and Procedures

Step 10: Apply for Enrollment at Pay.gov

Once you pass all three sections of the SEE, you will need to register as an Enrolled Agent. The application can be found at Pay.gov.

Step 11: Pass a Tax Compliance Check with the IRS

The Tax Compliance Check is basically a background check that begins once you submit your application (see Step 10). It takes up to 90 days.

Step 12: Spread the Word! You’ve become an Enrolled Agent!

Congrats! You’ve gained the highest credential in the tax industry! Tell your clients and add that designation to everything: your desk placard, business cards, email signature, and LinkedIn profile.

source http://www.theincometaxschool.com/blog/the-path-to-enrolled-agent/

Wednesday, August 9, 2017

Tuesday, August 8, 2017

Monday, August 7, 2017

Sunday, August 6, 2017

Saturday, August 5, 2017

Friday, August 4, 2017

Online Directories: A Great Way to Boost Your SEO

When you type in “tax preparer in [enter your city]”, does your firm come up? Is it at the top of search  results? There are a lot of things that factor into being on the first page of Google. Are you employing SEO tactics? Do you have a lot of competition? Is your site optimized with keywords? Is your competition using SEO tactics? Without getting into the details of SEO, we want to share with you one tactic that will help: submitting your information to online directories.

results? There are a lot of things that factor into being on the first page of Google. Are you employing SEO tactics? Do you have a lot of competition? Is your site optimized with keywords? Is your competition using SEO tactics? Without getting into the details of SEO, we want to share with you one tactic that will help: submitting your information to online directories.

Every directory you submit to is another chance to get found online – and there are a TON of directories you could submit your business to. Some of these are free and some you have to pay for. Here are some of the best directories to be in.

Google My Business

Have you claimed your business on Google yet? This is one of the most important listings. Claiming your business on Google allows you to customize your Google listing, add pictures, respond to reviews, and control what people see when they search your business on Google. Google even has an app that allows you to make changes from your phone. Once you’ve claimed your business you’ll need to go through their verification process via postcard or phone.

Yelp

Yelp is a crowd-sourced review site that helps consumers make better decisions based on reviews by the community. You should make sure that you have your Yelp profile claimed and customized. Just like Google, you can add photos, respond to reviews, and customize your business listing. You can also run ads and submit events.

Bing

Bing is an alternative search engine to Google and has its own business listing service. To get your business on Bing you’ll need to claim you profile, customize your listing, and then go through their verification process.

Better Business Bureau

The Better Business Bureau is a nonprofit organization focused on advancing marketplace trust. They collect and provide free business reviews and serves as an intermediary between consumers and businesses. There is a local BBB chapter in every city.

Angie’s List

Much like Yelp, Angie’s list is an online directory that allows users to read and publish crowd-sourced reviews of local businesses and contractors. As a business, it’s free to claim your profile.

Social Media

Social media channels like Facebook and LinkedIn are just as much a directory as they are a social platform. Make sure you have a presence on the relevant and popular sites so that you are searchable. Facebook, LinkedIn, Nextdoor, Twitter, and Alignable are all important.

Other Directories

While this is not an exhaustive list, here are some other directories to spend time adding your business to.

- Merchant Circle

- YP.com

- Whitepages

- Superpages.com

- Yellowbook

- CitySearch

- MapQuest/Yext

- Local.com

- Manta

- BizJournals.com

- ChamberofCommerce.com

For any of these directories, make sure you go beyond adding your name and contact information. Fill out your profile completely, add categories, add images, add your business hours, etc.

source http://www.theincometaxschool.com/blog/online-directories-boost-seo/