Saturday, September 30, 2017

Tax Reform Framework Observations

|

| Press conference on release of tax reform framework on 9/27/17 |

- Top corporate rate is 20% rather than President Trump's 15%. The 20% rate should help us be more competitive internationally, particularly along with a shift from a worldwide system to a territorial one (15% would be better, other than for the budget effect).

- The individual brackets will be 12%, 25% and 35% and perhaps something higher than 35%. In April, President Trump suggested 10%, 25% and 35% while last June the House Republicans suggested 12%, 25% and 33%. Today's lowest bracket (other than zero) is 10%. Seems odd to try to sell tax cuts with a higher lowest rate, but the effect also depends on where the brackets start and end and a few other provisions.

- There is a lot missing such as where individual tax brackets start and end, whether the head-of-household filing status will be repealed (it is not mentioned in the framework), what "additional tax relief" will be provided "during the committee process," the rate that applies to capital gains and other investment income, and whether interest expense of businesses operating as other than C corporations will be limited.

- While the standard deduction will be doubled, the personal exemptions and additional standard deduction (for age and blind) are removed. So, for example, today, a single person has a personal exemption of $4,050 and standard deduction of $6,300 for a total of $10,350. Doubling the standard deduction to $12,000 and removing the exemption means an increased deduction of $1,650 rather than $6,300.

- The dependency exemption is removed and replaced with a "significantly" larger child tax credit but it doesn't say how much higher. Also, the child tax credit is for children under age 17 while the dependency exemption covers up to age 23 and perhaps even higher in some instances.

- A more accurate measure of inflation will be used to adjust brackets, the standard deduction and phase-outs. This makes sense but does mean that future adjustments will be less than we have today (this is a revenue raising provision).

- Will repeal of the estate tax also include repeal of the step-up (or down) in basis at date of death or similar measure to ensure that gains at death don't escape both the estate tax and the income tax which would be a tremendous benefit to wealthy individuals?

*Mnuchin, Cohn, Brady, Hatch, McConnell and Ryan

source http://21stcenturytaxation.blogspot.com/2017/09/tax-reform-framework-observations.html

Friday, September 29, 2017

Thursday, September 28, 2017

Wednesday, September 27, 2017

Tuesday, September 26, 2017

Monday, September 25, 2017

Who should get a rate cut in tax reform?

Most businesses don't operate as C corporations. Instead, they operate as sole proprietors, partnerships, LLCs and S corporations. For these entities, the income mostly is taxed at the individual tax rates where the top rate is 39.6% although less than half of one percent of individuals are in that top bracket. According to a recent report from the Joint Committee on Taxation (JCT), for 2016, it is estimated that only 6% of individual returns report income of $200,000 or more. For married taxpayers filing jointly, at $200,000 of taxable income, about $45,000 of that income is taxed at 28%. They would need to have over $233,350 in 2016 to get to a 33% marginal tax rate, over $415,700 to get to a 35% marginal rate and over $470,700 to reach a 39.6% marginal rate. If their income consists of capital gain income, it is taxed at 0% and 15% and doesn't reach 20% until income exceeds $470,700. Basically, very few individuals are at today's top individual rates although many who are have a lot of income.

|

| JCT, JCX-42-17 (9/15/17) |

Recently, Treasury Secretary Mnuchin stated that accounting firms would not get a lower rate even if the rate is reduced for non-C corp entities. He implied that only firms creating manufacturing jobs would justify a rate cut. (Bloomberg, "Trump Officials Temper Expectation of 15% Corporate Tax Rate," by Mohsin and Sink, 9/12/17.) Wow! The government produces lots of data, but I'm concerned that not many policy makers look at it. According to the Bureau of Labor Statistics, accounting jobs are growing faster than for other industries - at an 11% rate. And these are good paying, interesting jobs that are key to business growth overall. In contrast, jobs for fabricators and assemblers are declining by 1%.

Barry Melancon, President and CEO, has a blog post on Secretary Mnuchin's comments and the justification for lowering all business tax rates as part of reform - check it out. Also see this AICPA testimony for the Senate Finance Committee's hearing of 9/19/17 on business tax reform.

Note: For the rate cut for non-C corporations, the owners must first pay themselves reasonable compensation to be taxed at individual rates + payroll taxes. The remaining income would be taxed at a lower top rate than other individual income though.

What do you think?

source http://21stcenturytaxation.blogspot.com/2017/09/who-should-get-rate-cut-in-tax-reform.html

Sunday, September 24, 2017

Saturday, September 23, 2017

Friday, September 22, 2017

Thursday, September 21, 2017

Wednesday, September 20, 2017

Free Resources for Tax Preparers

At The Income Tax School, our mission is to empower people with a professional career to fulfill their dreams and serve others as industry leaders. That’s why, along with all of the materials and support we provide to students, we also strive to write informational blog posts and other free sources of information.

Did you know that we have a ton of free, downloadable white papers? We just updated all of our Free White Papers, so we thought we’d take the time to tell you about them!

White Papers to Share with Clients

Communicating with clients is extremely important. It’s helps them stay informed, it encourages them to be proactive, and makes you look like a superstar! Here are some white papers to share with your clients.

Top Ten Causes of Taxpayer Pain

To help taxpayers understand and cope with the frustration caused by our tax system, I’ve compiled the following “Top Ten Causes of Taxpayer Pain” and my thoughts on how to alleviate the pain.

Why Your Tax Return Should Be Prepared Early

Getting clients to come in early during tax season can be extremely difficult. This white paper might help convince them.

Choosing the Right Tax Preparer For You

A great marketing tool to use for prospective clients.

Signs It’s Time to Call a Bookkeeper

If you offer bookkeeping services to business clients, this is a great tool to help bring more business in.

White Papers for People Interested In Tax Preparation

Thinking about becoming a tax preparer? We’ve got some things for you to read.

Tax Preparation Can Be A Stop Gap for Unemployed Workers

12 Advantages of a Career as a Tax Professional

White Papers for Tax Pros

Getting Hired as a Tax Preparer

You’ve got the education, now it’s time to land the job. These tips will help.

10 Reasons to Earn CE and Tax Pro Credentials

Never stop learning. Here’s why.

White Papers for Tax Business Owners

Leveling the Playing Field – How to Compete with National Tax Firms

Learn the strategies of the big firms.

Free Guide to Recruit and Train Tax Preparers

Looking to hire? In this paper we lay out how to choose people who would be great tax preparers and then teach tax preparation.

Top 3 Strategies for Successful Tax Business Marketing

These tried and true marketing strategies constitute best practices for any independent tax business to attract and retain clients.

12 Low Cost Ways to Recruit Tax School Students

We’ve found that the best way to recruit and train tax preparers for your business, is to run a tax school in the off season.

Tips for Training Staff Before Tax Season

Are you being thorough enough when you bring new staff on board? These tips will help.

4 Game Changer Internet Marketing Tips

These 4 internet marketing strategies are more cost effective (and more effective) than “traditional” advertising.

We hope you find these white papers insightful! Want more resources? Check out our Resources Page and join our LinkedIn Group, Tax Business Owners of America.

source http://www.theincometaxschool.com/blog/free-resources-for-tax-preparers/

Tuesday, September 19, 2017

Monday, September 18, 2017

Sunday, September 17, 2017

Saturday, September 16, 2017

Corporate tax contributions to the states

One of the major drivers of the latest federal tax reform effort is the corporate tax rate.

The Trump Administration is still pushing for a 15 percent corporate tax rate, the White House's budget director, Mick Mulvaney, told CNBC last week.

However, just the day before Treasury Secretary Steven Mnuchin conceded a 15 percent rate would be difficult to attain.

Meanwhile, one Washington, D.C.-based tax policy group has looked at how much corporate taxes contribute per capita to state coffers.

That analysis by The Tax Foundation earns this week's Shout Out Saturday honors.

Not a major tax matter: "The corporate income tax is one of the smallest sources of state tax revenue," writes Morgan Scarboro, a policy analyst at The Tax Foundation. "According to Census data, in FY 2015, the corporate income tax only comprised 5.3 percent of state tax collections."

The corporate income tax also often is mistakenly seen as the only taxes businesses face. Wrong, notes, Scarboro. Companies also pay sales tax, property tax, excise tax and payroll tax.

In fact, the corporate income tax makes up only 9.5 percent of total business taxes.

The Tax Foundation's map below shows how much state governments collect in corporate income taxes per capita.

Where it does count: New Hampshire collects the most at $433 per capita, with Delaware shortly behind at $424 per capita.

On the other end of the business tax spectrum, six states don't levy a corporate income tax at all. They are Nevada, Ohio, South Dakota, Texas, Washington and Wyoming.

Just some more tax data to keep in mind as the 2017 Internal Revenue Code rewrite effort continues.

You also might find these items of interest:

- 4 tax tips for new businesses

- The importance of good, and separate, business records

- Make sure you start your business intending to turn a profit

source http://www.dontmesswithtaxes.com/2017/09/corporate-tax-contributions-to-the-states-.html

Friday, September 15, 2017

Disaster Relief Tax Links

The IRS has lots of information to help - here + Pub 547.

COST and the AICPA have a list of information from state tax agencies about state relief.

The AICPA has information for tax practitioners:

source http://21stcenturytaxation.blogspot.com/2017/09/disaster-relief-tax-links.html

Hurricane Jose is back; Eastern Seaboard could be affected

I know it's peak Atlantic hurricane season, but this has to stop. If only my pleas were that powerful.

Instead, all I can do is let you know that Jose, who's been meandering the Atlantic for weeks, has reformed and is back at hurricane force.

The National Weather Service's National Hurricane Center announced in its 5 p.m. ET tropical alert that Jose's sustained winds were 75 miles per hour, making it a Category 1 hurricane.

Jose, which started on Aug. 31 as a tropical wave off the west coast of Africa, developed into the 10th named storm of the 2017 season, the fifth hurricane and the third major hurricane. It previously had reached Category 4 strength before losing momentum and becoming a tropical storm.

It's now about 640 miles southeast of North Carolina (or if you're a dedicated storm tracker the system is near latitude 27.1 North, longitude 70.3 West) and is slowly (10 mph) moving northwest. The National Hurricane Center (NHC) expects it to maintain that course today, then turn to the north-northwest by late Saturday, Sept. 16, and then go more northerly on Sunday, Sept. 17.

In addition, the NHC says Hurricane Jose should strengthen through Saturday, with weakening possibly beginning late Sunday.

Currently, hurricane-force winds extend about 35 miles from the center of Jose, with tropical-storm-force winds felt as far as 140 miles from its core.

In addition to winds, Hurricane Jose is producing ocean swells off of Bermuda, the Bahamas, the northern coasts of Hispaniola and Puerto Rico, and the southeastern U.S. coast. The more turbulent seas are expected to spread northward along the Mid-Atlantic coast during the next few days.

And the cone of uncertainty puts the upper East Coast of the U.S. in uncomfortable territory.

Since we've all watched in recent weeks as Harvey and Irma shifted before making landfall in Texas and Florida, respectively, all we can do is, as the saying goes, stay tuned.

Oh, and be/get prepared.

While I appreciate the readership, I'm really getting tired of referring y'all to my Storm Warnings page. But it is where you can find links to previous blog posts about getting ready for a storm (or any other natural disaster), recovering afterwards and helping those who were in a storm's path.

Finally, be careful. No piece of real estate or personal property is worth putting yourself in danger.

source http://www.dontmesswithtaxes.com/2017/09/hurricane-jose-is-back-eastern-seaboard-could-be-affected.html

Thursday, September 14, 2017

Wednesday, September 13, 2017

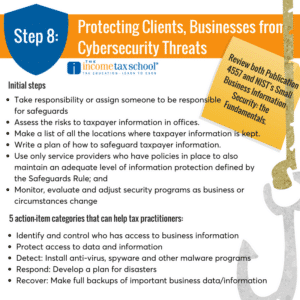

Protect Your Clients From Cybersecurity Threats

As a tax practitioner, you have a legal obligation to protect your client’s information. That means taking all the necessary measures to make sure that the information you’re given is safe from cybercriminals. The IRS recently sent out information on how to do so through their Don’t Take the Bait campaign, a 1o part series that provides security tips to tax preparers.

“More and more, we see the data held by tax professionals being targeted by national and international criminal syndicates that are highly sophisticated, well-funded and technologically adept. No tax practitioner today can afford to ignore cybersecurity threats or overlook putting in place strong safeguards.” – IRS Commissioner John Koskinen.

Your Legal Obligations

If you handle taxpayer information, you may be subject to the Gramm-Leach Bliley Act (GLB Act) and the Federal Trade Commission (FTC) Financial Privacy and Safeguards Rules. That means you must take the following steps to protect taxpayer information.

- Take responsibility or assign an individual or individuals to be responsible for safeguards.

- Assess the risks to taxpayer information in your office, including your operations, physical environment, computer systems and employees, if applicable. Make a list of all the locations where you keep taxpayer information (computers, filing cabinets, bags, and boxes taxpayers may bring you).

- Write a plan of how you will safeguard taxpayer information. Put appropriate safeguards in place.

- Use only service providers who have policies in place to also maintain an adequate level of information protection defined by the Safeguards Rule.

- Monitor, evaluate and adjust your security program as your business or circumstances change.

For more information, check out IRS Publication: Safeguarding Your Taxpayer Data.

IRS Tips

The IRS recommends reading up on Publication 4557 and NIST’s Small Business Information Security. Here are their tips for protecting clients and businesses from cybersecurity threats.

Identify:

- Identify and control who has access to business information

- Conduct background checks

- Require individual user computer accounts for each employee

- Create policies and procedures for information security

Protect:

- Limit employee access to data and information

- Install Surge Protectors and Uninterruptible Power Supplies (UPS)

- Patch operating systems and applications

- Install and activate software and hardware firewalls on business networks

- Secure wireless access point and networks

- Set up web and email filters

- Use encryption for sensitive business information

- Dispose of old computers and media safely

- Train employees

Detect:

- Install and update anti-virus, spyware and other malware programs

- Maintain and monitor logs

Respond:

- Develop a plan for disasters and information security incidents

Recover:

- Make full backups of important business data/information

- Make incremental backups of important business data/information

- Consider cyber insurance

- Make improvements to processes, procedures and technologies

Now is a great time to look over your protocols before tax season. Protecting taxpayer information should be top of mind as cybersecurity threats continue to increase. In addition to protecting client information, you should also make sure you’re covered in the event of a data breach.

More great reads:

Protect Yourself and Clients From Cybercrime

Tax Scam Roundup: Know What You’re Up Against

The Common Denominator in Most Tax Scams

source http://www.theincometaxschool.com/blog/protect-clients-cybersecurity-threats/

Tuesday, September 12, 2017

Monday, September 11, 2017

Sunday, September 10, 2017

Saturday, September 9, 2017

Friday, September 8, 2017

Thursday, September 7, 2017

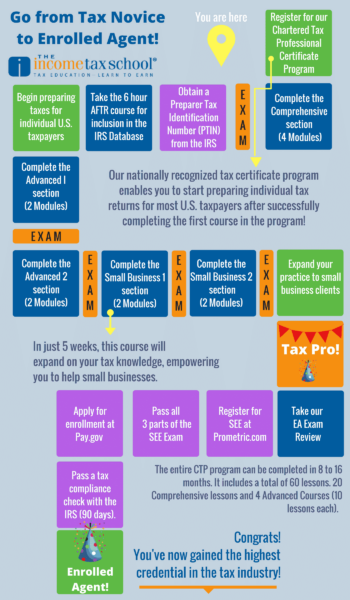

Go Back to School this Fall and Win Big Next Tax Season

Want to earn more as a tax preparer this coming tax season? That means you need learn more. Gaining knowledge and experience as a tax preparer is the only way to earn more money in the industry. That means it’s time to hit the books and go back to school. Furthering your tax education could mean:

- Offering more services to clients

- Increasing your fees

- Earning credentials and/or a higher status

- Becoming your own boss

Here are 3 ways you can “Go Back to School” with the Income Tax School so that next tax season you can earn more money.

Learn Advanced Tax Preparation

Comprehensive tax courses teach you how to prepare taxes for the general public. Advanced courses expand your services to business clients, corporate clients, or people with more complex tax situations. Increasing your knowledge will allow you to take on more lucrative clients. The Income Tax School offers a number of Advanced Tax Preparation Courses. You could also just expand your knowledge to specific situations (or forms) that you may not be experienced in. If that’s the case, check out our CE Course packages.

Earn Credentials

Earn Credentials

Another great way to advance your career and set you apart from unqualified tax preparers is by earning one of two credentials in the industry. The first is a Record of Completion through the IRS Annual Filing Season Program. This program is an annual voluntary IRS tax training program. It aims to recognize the efforts of non-credentialed preparers who aspire to a higher level of professionalism.

But why stop there? Your ultimate goal should be to earn the highest designation possible: Enrolled Agent. Enrolled Agents (EAs) have unlimited practice rights. This means Enrolled Agents are unrestricted as to which taxpayers they can represent, what types of tax matters they can handle, and, which IRS offices they can represent clients before. Learn more about the Pathway to Becoming an Enrolled Agent.

Learn How to Start and Grow Your Own Tax Business

You’ve got the education, why not be your own boss? Becoming a tax business owner is easier than you might imagine. The Income Tax School has lots of great resources for starting your own tax business. You could learn to build your business by diving into our Tax Practice Management Manuals, or check out my new book, Guide to Start and Grow Your Successful Tax Business.

Whatever you do to prepare for next season, make continuing education important and you will surely reap the benefits come January!

source http://www.theincometaxschool.com/blog/back-to-school/