Monday, July 31, 2017

Sunday, July 30, 2017

‘Trump Effect’ appears to have cost states tax money

Every taxpayer is well aware of the length of the federal tax tentacles. What Congress does to the Internal Revenue Code affects state taxes, too.

And it’s not just the residents who live in the states who are affected. It’s the states themselves.

Even before any tax code changes have been made, many are already feeling the Trump Effect on their treasuries.

“April income tax returns brought bad news for state budgets,” according to the Rockefeller Institute of Government. “Payments with tax returns usually arrive in April and early May, and often they are surprising. By mid-to-late May, states know whether those payments were surprisingly good or surprisingly bad. The news often comes as states are finalizing the budget for the new fiscal year, complicating this already challenging task.”

This year, the news was not good.

Tax take lower in most states this year: The Rockefeller Institute collected data from 41 states with broad-based income taxes. This April, total state income tax revenue was down 4 percent compared to the previous year, driven by declines of 7.3 percent in final returns and 4.3 percent in estimated payments.

Those reduced tax collections more than offset the 5.3 percent growth in withholding tax collections.

Overall, April income tax revenue fell in 24 of the 41 states for which the public policy think tank obtained data.

“Although many states had forecasted declines in April and May, they were worse than expected,” noted Donald J. Boyd and Lucy Dadayan, who examined the data for the research arm of the State University of New York (SUNY) and compiled the report, released July 17.

The tax receipt declines were largest in the New England and Mid-Atlantic states, followed by Southern states. The only good treasury news came from the Great Lakes and Rocky Mountain states, where April tax revenue was up from last year.

What does all this spring’s state tax collection have to do with Washington, D.C., and specifically the 45th president?

Although the date is data isn’t complete, Boyd and Dadayan say “strong indications point to a Trump Effect.” It looks like individuals shifted income out of 2016 in the hope of benefiting from promised cuts in federal tax rates that Donald J. Trump proposed during the campaign.

Tax prep, tax effects: Such economic shifts in anticipation of major federal policy changes are nothing new.

When Congress raised the top tax rate as part of the fiscal cliff negotiations in 2012, wealthy taxpayers moved some income into that year so that it would be taxed at the then-lower rates. That income shifting produced a windfall for states in April 2013 when taxes were filed on all that added money.

The following year, however, resulted in a revenue slump as taxpayers had less income subject to the higher federal rates. That carried over to state receipts, too.

Now, higher-income taxpayers must wait to see if Trump and the GOP can deliver on the lower promises made during last year’s campaign.

Tax wait could have more effects: How much lower is still up for debate. Candidate Trump promised to lower the top personal income tax rate from 39.6 percent to 35 percent. He also wants to lower the top tax rate for businesses to 15 percent, giving those corporations a reason to delay taking income.

Then there’s the matter of the 3.8 percent net investment income tax that helps pay for the still (for now) on the books Affordable Care Act. Will Congress make another attempt to repeal and replace Obamacare and its associated taxes? If so, will the Republicans succeed this time and will some ACA taxes remain anyway, as was the case in some GOP proposals?

Also still up in the air is exactly when any lower rates might take effect.

Past tax law changes have taken effect either on the date the bill was signed, a specific date cited in the legislation or made retroactive to a past date, generally the start of the tax year in which the measure became law.

If tax reform (or at least simply lower tax rates, as is looking more likely) takes a while (which also is looking more likely), any changes could take effect next year.

If that’s the case, look for a repeat of what happened in 2016, with wealthy filers pushing money out of the 2017 tax year and into 2018.

And sorry state governments. That would likely produce the same type of revenue hits that you took this April.

You also might find these items of interest:

- Many Americans oppose Trump's tax plan; want to see his tax returns

- BAT strikes out and other insights from the GOP's latest tax reform guidelines

- House Problem Solvers Caucus (a real group!) sets sights on passing tax reform

source http://www.dontmesswithtaxes.com/2017/07/trump-effect-appears-to-have-cost-states-tax-money.html

Saturday, July 29, 2017

Friday, July 28, 2017

Thursday, July 27, 2017

What Does the Use of AI in Tax Preparation Mean for Tax Preparers?

AI is the hot technology term these days. It seems to be “disrupting” just about every industry you can think of – including the tax industry. This past tax season, H&R Block partnered with IBM Watson to use its powerful AI capabilities in 10,000 of its U.S. offices. The initial focus of the technology was to help H&R Block preparers recommend deductions and credits to clients.

It begs the question: how far will AI go? Who’s to say companies like Turbo Tax won’t leverage the  technology completely eradicate the need for a tax preparer? According to a report by PwC, AI tools could potentially replace the basic capabilities on first and second year tax associates.

technology completely eradicate the need for a tax preparer? According to a report by PwC, AI tools could potentially replace the basic capabilities on first and second year tax associates.

The report also predicts that AI will be able to optimize the best outcome and course of action for large companies with lots of data. It can help by taking large sets of data like supply chain data, SKU level sales data, tax data, and external environment data and use it to optimize effective tax rates (ETR) and tax efficient profitabilities.

Does this mean it will replace human tax preparers? We don’t think so. AI can do a lot but here are some things it can’t do:

- Represent taxpayers in front of the IRS.

- Reassure taxpayers when they think all hope is lost.

- Answer the one million questions a taxpayer may have.

- Provide personalized customer service.

What you should be excited about

While Block seems to have the advantage right now, it doesn’t mean all hope is lost for smaller tax preparation firms. There’s actually a lot to be excited about.

First, think of the data and historical patterns that could be uncovered if the IRS was to adapt the technology? There’s a lot that could improve in terms of customer service and industry data.

PwC principal and tax technology and process leader Michael Shehab, “What has been missing in this industry for a long time, and what we’re really focused on, is not just delivering a tax return but delivering the analytics associated with the tax return. We’re trying to make the tax return preparation process more efficient, but we’re also trying to make it higher value added rather than simply delivering a tax return.”

Second, there’s a lot of time that could be saved with AI as your tax assistant. Categorizing and processing information that has different formats, statistical modeling, tax research, generating K-1 schedules, etc. Using AI to automate repetitive tasks could help tax preparers elevate themselves to do more reviewing rather than being bogged down with data and paperwork each season. This could have huge impacts at the corporate level when there’s a lot more data to deal with.

How to avoid being replaced by a robot

Tax preparers should really be looking to arm themselves with as much tax knowledge as possible. Competition is already steep when it comes to preparing taxes for the general public. You’re competing with tax software, national firms, and everyone else who “hangs a shingle”. But there will always be a need for Enrolled Agents, who have the highest designation in the industry and are the only industry professionals who have unlimited representation rights in front of the IRS. The more tax education you can get the better. When tax trouble comes knocking, taxpayers will always opt to do business with a person over a computer.

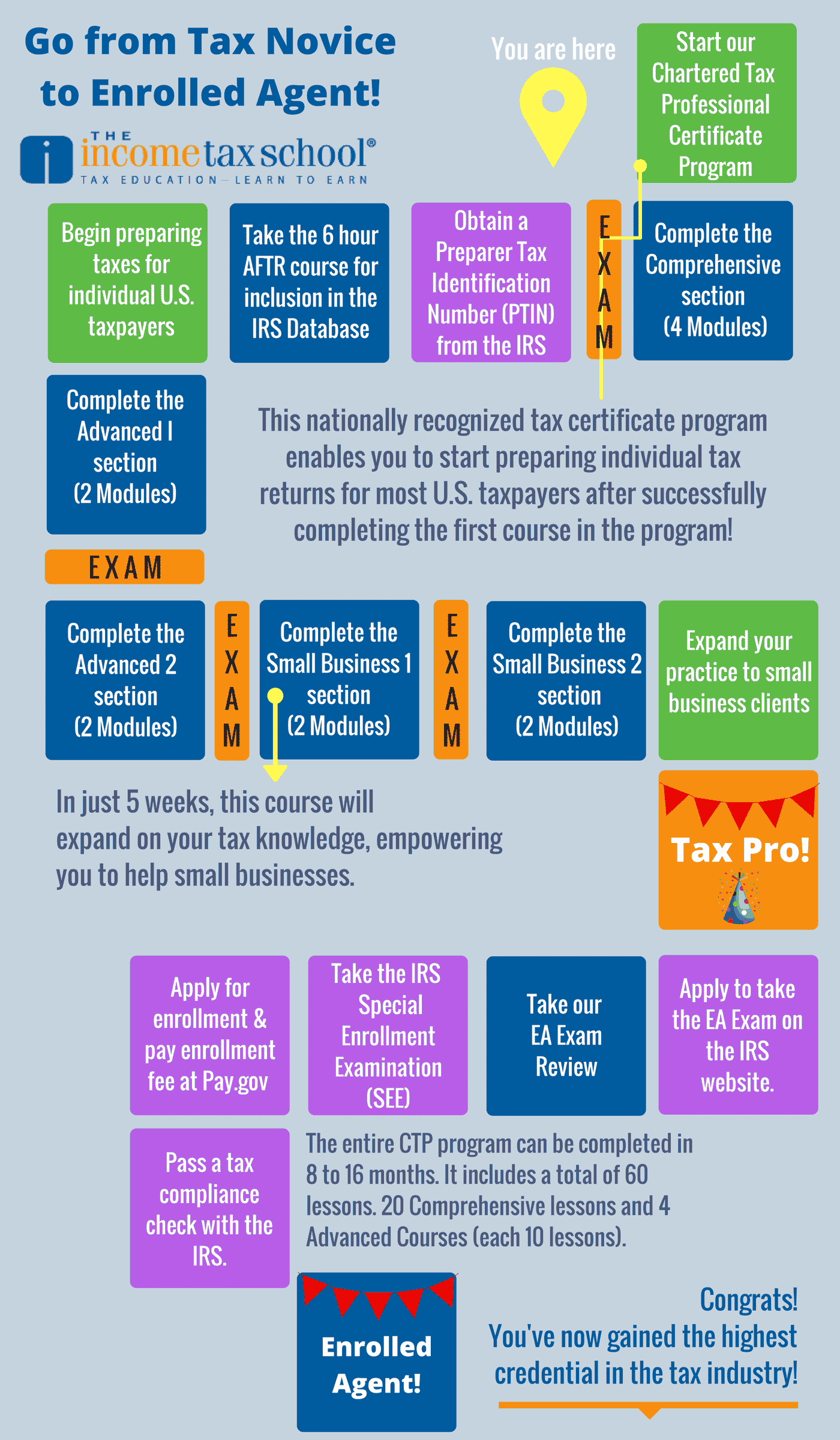

So how do you attain that knowledge? Our Chartered Tax Certificate Program is a clear path to Enrolled Agent. You’ll learn everything you need to know to prepare yourself for the SEE (Special Enrollment Exam). Here’s how it works:

source http://www.theincometaxschool.com/blog/what-does-the-use-of-ai-in-tax-preparation-mean-for-tax-preparers/

Ryan Foresees Tax Reform Legislation This Year

So, it appears that the plan will:

- Not be a consumption tax as proposed last June by the House Republicans. Thus, sounds like the plan will allow a deduction for imports and tax export revenue, and allow a deduction for interest expense of businesses. And, expensing of business assets is not a given, but there may be non-consumption tax reasons for allowing such expensing. Also, with asset expensing, it's likely not all business interest expense will be deductible (assuming asset expensing is in the final plan).

- Looks like both businesses and individuals will get a rate cut. How much of a tax reduction that translates to depends on what changes are made to deductions and credits, the AMT, and for higher income individuals, what happens to capital gain rates and the net investment income tax.

- And likely a shift to a territorial system as Senator Hatch noted recently that this has bipartisan support and was part of both the House plan and President Trump's 1-page plan.

source http://21stcenturytaxation.blogspot.com/2017/07/ryan-foresees-tax-reform-legislation.html

Wednesday, July 26, 2017

Tuesday, July 25, 2017

Monday, July 24, 2017

Sunday, July 23, 2017

Saturday, July 22, 2017

Friday, July 21, 2017

Thursday, July 20, 2017

ACA tax hits the court

source http://21stcenturytaxation.blogspot.com/2017/07/aca-tax-hits-court.html

Expand Your Social Media Arsenal This Summer

Facebook, Twitter, LinkedIn… these are the three standard channels we all think of when it comes to  social media marketing. But they aren’t the only ones. There’s also Instagram, Snapchat, YouTube and Pinterest (to name a few). Social media has a major force in marketing and communications – one that tax preparers should not be ignoring.

social media marketing. But they aren’t the only ones. There’s also Instagram, Snapchat, YouTube and Pinterest (to name a few). Social media has a major force in marketing and communications – one that tax preparers should not be ignoring.

Beyond the most popular three, there are some channels growing in popularity that could be effective marketing tools for tax preparers. What better time to learn and test these tools than during the summer months when business is slower? No, we’re not going to try to sell you on Snapchat. We’re talking about Alignable and Nextdoor. Here’s what you need to know about them.

Alignable

Alignable is a networking platform for small businesses that focuses on building relationships locally. The platform goes beyond asking people for recommendations and connecting to other businesses. On Alignable you can:

- Ask questions

- Show off your expertise by answering questions

- Get and give recommendations

- Tell your story and explain your services

- Connect your Facebook page

- Rate the services you use

- Research other services like Mailchimp and Yelp by looking at their ratings

- Highlight upcoming events and promotions

The platform uses geolocation features to recommend other businesses in your neighborhood to connect with. Use these to find and recommend people you already do business with, and find new people to meet and network with online. It’s a great way to get to know the businesses around you and a great tool to help share your expertise or ask others for theirs.

Nextdoor

Nextdoor is a social network designed to connect you with your neighbors and community in order to build stronger, safer neighborhoods. It’s hyperlocal, and a great resource for communicating what’s happening (i.e. alerting people to a lost dog, a garage sale, a plant exchange, etc.).

Local businesses are just as important to the neighborhood as residents are so, in addition to having a personal account, you can claim your business. Once claimed, businesses can get recommendations, include information about their location and hours, and reply to comments and messages. Nextdoor doesn’t require as much attention as other platforms but is a passive way of getting referrals and recommendations from locals who love you.

Unlike other social media platforms, these two don’t require a constant need for writing posts. Claim your business on these channels and give them a whirl! If you’re already using them we’d love to hear what you think.

source http://www.theincometaxschool.com/blog/social-media-nextdoor-alignable/

Wednesday, July 19, 2017

Adoption tax breaks help cover costs of adding to your family

If you've been paying attention to Donald Trump Jr.'s meeting with some Russians last summer, you know the White House has given two reasons for the get-together. The explanation that caught my tax eye was that the group talked about adoptions.

The president's oldest son said that one of the Russian nationals came to Trump Tower to lobby for reversal of the Magnitsky Act. The law gets its name from attorney Sergei Magnitsky, who died in 2009 while being held in a Moscow prison.

Foreign fight, domestic family effects: In 2012, the U.S. law bearing Magnitsky's name was enacted. It froze the assets and banned entry of 18 Russian officials believed involved in corruption that Magnitsky helped expose. Russia retaliated by banning U.S. citizens from adopting Russian children.

Mention of Magnitsky immediately reminded me of his conviction on tax evasion charges by a Russian Court — two years after he died.

The talk of adoption also got me thinking about the tax breaks available to U.S. citizens who use this legal process add to their families. And Uncle Sam's help is definitely welcome, so it's this week's Weekly Tax Tip.

Tax help for costly family additions: Data compiled by the Child Welfare Information Gateway found that in 2016 parents who work with a private agency to adopt a newborn, either domestically or from another country, could pay as much as $40,000.

However, the Internal Revenue Code helps eligible adoptive parents cover some of the costs of adding to their families.

Some employers provide a tax-free adoption benefit. There's also a sizable adoption tax credit.

For the 2017 tax year, a company can provide eligible employees up to $13,570 in tax-free assistance to go toward adoption costs. The amount is adjusted annually for inflation.

In addition, parents in 2017 can claim an adoption tax credit of $13,570 when they file their returns.

Some tax break restrictions: The good news for people seeking to add to their families via adoption is that this tax credit — which provides a dollar-for-dollar reduction in any tax liability — is per child.

The slightly bad news is that the adoption tax credit is nonrefundable. That means it can only erase the amount of tax you owe, not get you a refund if the credit is more than your tax bill.

Still, zeroing out a tax bill is always a good thing. And there's a silver tax lining. Any excess tax credit may be carried forward for up to five years.

Depending on the adoption's cost, you may be able to claim both the tax credit and the income exclusion from your employer.

However, you must use any allowable exclusion amount before you file for the adoption tax credit. And you can't double dip; that is, you cannot claim both the credit and exclusion for the same expenses.

Income limits tax benefits: Both the tax-free employer provided adoption assistance and the tax credit also are affected by the new parents' earnings.

The amount of both tax breaks begins to phase out when the new adopting taxpayer's modified adjusted gross income (MAGI) is more than certain limits, also adjusted for inflation each year.

In 2017, that earnings threshold is $203,540 regardless of filing status. The tax-favored assistance ends totally once the adoptive parents' MAGI hits $243,540.

Credit for qualifying kids: Of course, there also are rules regarding your new family member. To claim the adoption tax credit or use the workplace benefit, you must adopt or try to adopt an eligible child.

The Internal Revenue Service defines an eligible adopted child as a youngster age 17 or younger. Though not as common, the IRS says an eligible adoptee also can be an older person who is physically or mentally incapable of caring for him- or herself.

If you're looking to adopt a U.S. child, the IRS defines this youth as one who was a citizen or resident of the United States (including possessions) at the time the adoption process began.

There also are special rules for adoption of a U.S. child with special needs, you may qualify for the full amount of the adoption tax credit even if you paid few or no adoption-related expenses, once the adoption is final.

A special needs child is one whom a U.S. state or county child welfare agency has determined is not likely to be adopted unless the government provides assistance to the adoptive family. Foreign children aren't considered to have special needs for purposes of the adoption credit.

Timing of claims: When you can claim your adoption expenses and how much is affected by whether you adopt U.S. child, a special needs youth or a youngster from another country.

For domestic adoptions, before the adoption is final you claim eligible expenses (more on these is coming up) in the year after you paid them. Once you're officially a new family, you claim expenses incurred that year on that year's tax return.

And if for some reason the adoption doesn't go through (so sorry), you still can claim the costs you incurred in trying to add to your family.

The rules for a foreign adoption are slightly different. In these cases, any costs you paid cannot be taken until the year the adoption is final.

Whether you adopt a U.S. or foreign child, once your adoption is completed, any expenses you incur after that can be claimed in the year they are paid.

In the case of a special needs adoption, you may qualify for the full amount of the tax credit once the adoption is final even if you paid few or no adoption-related expenses.

Allowable adoption expenses: OK, you know when to claim your adoption expenses. Now just what costs can you count toward the adoption credit?

Qualified adoption expenses are what the IRS calls "reasonable and necessary" adoption fees. These include:

- Adoption fees,

- Court costs,

- Attorney fees,

- Travel expenses, including amounts spent for meals and lodging while away from home, and

- Other expenses directly related to the legal adoption of an eligible child.

You cannot, however, count expenses for adopting your spouse's child or for a surrogate parenting arrangement.

More issues, more info: In keeping with the complexity of adopting a child, claiming the tax credit or income exclusion can get tricky.

You can find additional details on the adoption tax credit in Form 8839, which you file to claim the tax credit, and its instructions, as well as in Tax Topic 607, Adoption Credit and Adoption Assistance Programs.

The IRS also has an online app that helps you determine if you're eligible to claim the adoption tax credit or exclude from your income any assistance you got in adopting.

State adoption assistance, too: Finally, don't forget possible state tax help.

Some states offer similar types of tax credits or deductions for adoptive parents. Check with your state's tax department, the North American Council on Adoptable Children (NACAC) or the Child Welfare Information Gateway.

You also might find these items of interest:

- How kids can help cut your tax bill

- IRS can now share tax data to help find missing kids

- 5 tests a child must meet to be claimed as a tax dependent

source http://www.dontmesswithtaxes.com/2017/07/adoption-tax-credit-income-exclusion.html

Tuesday, July 18, 2017

Monday, July 17, 2017

Are California taxes high?

|

| California State Sales Tax Rate Breakdown. Most cities also have sales tax making the total rate higher, such as 9.25% in San Jose. |

Are California's taxes high? I was asked this question recently by a reporter with Politifact California. Assemblymember Travis Allen who is running for governor had stated that California had the highest taxes. His website says that California has the highest personal income tax and state sales tax rates. [Chris Nichols article of 7/11/17]

If just looking at the rate structure, those are correct statements. The Federation of Tax Administrators posts helpful and current tables of the PIT and sales tax rates among the states.

So far as the California personal income tax though, less than 5% of individuals are at the highest rate of 13.3%. Many Californians owe little or no state income tax because the exemptions in California are fairly high.

But, everyone pays the sales tax, directly and indirectly.

When a state has high tax rates, it is due to two possible reasons (and perhaps both at the same time):

- A narrow tax base

- Lots of spending

source http://21stcenturytaxation.blogspot.com/2017/07/are-california-taxes-high.html

Sunday, July 16, 2017

Saturday, July 15, 2017

Friday, July 14, 2017

Thursday, July 13, 2017

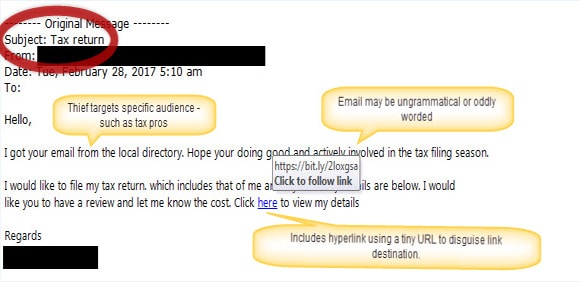

IRS Launches New Educational Series on Cybercrime

Taken from the IRS notice: an example of a spear phishing email that targeted a tax professional during the 2017 filing season

We’ve been talking a lot about phishing scams and tax fraud lately. It’s a very serious problem that has lots of people in the industry talking – including the IRS. Cybercriminals have become increasingly sophisticated, which means taxpayers and tax professionals need to become more educated about how these scams work. We talked about this in the blog a few weeks ago: Would You Take the Bait? Why Phishing Scams Should Concern You.

This week, the IRS announced the launch of a new cybersecurity awareness effort designed to educate tax pros, who are one of the most targeted groups when it comes to cybercrime.

Don’t Take the Bait

The Don’t Take the Bait Series is part of US-CERT’s “Protect Your Clients, Protect Yourself” campaign. This 10 week campaign covers spear phishing emails, business identity theft, account takeovers, ransomware attacks, remote takeovers, business email compromises, and Electronic Filing Identification Number thefts.

Since the IRS and other agencies have taken measures to make sure cybercriminals don’t get their hands on sensitive information or file fraudulent returns and collect taxpayer money, cybercriminals have set their sites on a new target: tax professionals who also have the necessary info to steal someone’s identity.

In fact, according to the IRS, there were 177 tax professionals or firms that reported data thefts from January through May of this year. That’s thousands of stolen taxpayer data! The IRS is currently receiving 3-5 data theft reports per week from tax professionals.

According to Commissioner Koskinen, “We continue to see new and evolving threats involving data breaches, intrusions and various takeovers that put people’s personal information at risk. These efforts are increasingly targeting tax professionals and businesses with tax information. Too many still overlook basic security steps needed to protect their data. As part of this, we urge the tax professional community: Beware your inbox. Don’t take the bait from these phishing scams.”

If you haven’t already, take a look at their first news release, that lays out what a phishing scam is and how to identify it: Don’t Take the Bait, Step 1: Avoid Spear Phishing Emails. It’s extremely informative and helpful! Look for these releases each week through the end of the IRS Tax Forums in September.

For more education on cybercrime and tax fraud, check out these resources:

Avoiding Social Engineering and Phishing Attacks

Season of Risk: Preparers Face Malpractice Suits

Protect Yourself and Your Clients from Cybercrime

What Kind of Idiot Gets Phished?

source http://www.theincometaxschool.com/blog/irs-launches-educational-series-cybercrime/

Wednesday, July 12, 2017

Becoming a Tax Business Owner Doesn’t Take Much

Set your own schedule.

Make your own rules.

Answer only to your clients.

Who doesn’t want to be their own boss, right?

If you’re getting into, interested in, or are already working in the tax industry, you may be surprised at what little it takes to start your own business as a tax preparer. Getting started is easy so long as you have the education and courage to take that leap. In this blog post we will lay out the bare minimum necessities to become an independent tax preparer.

Education

The first step is an education. You can start with a basic tax education and earn money preparing returns for the general public while learning to prepare more complicated returns (that will earn you more money).

Our Comprehensive Tax Course is a great place to start.

PTIN Number

PTIN stands for Preparer Tax Identification Number. This number is required by the IRS for anyone who prepares or assists in preparing federal tax returns for compensation.

Check out the IRS’s PTIN Application Checklist to find out more.

EFIN

Before you can electronically file tax returns, you must apply to become an Authorized e-file provider with the IRS. Once you are approved, you will be given an IRS Electronic Filing Identification Number (EFIN) so you can e-file tax returns.

Business License

Of course, if you are going to do business, you will need a business license. These are very easy to obtain and can be done by going down to your local city or town hall.

SBA’s guides to obtaining a business license

Computer

You’ll also need a computer to run tax professional software, communicate with clients, etc.

Professional Tax Software

Choosing professional tax preparation software will depend on what type of tax returns you will be preparing and what you can afford. You can choose anything from a simple pay-per-return package, to a basic tax software package that will enable you to prepare simple returns, to a very advanced tax program that will allow you to prepare all types of tax returns with many bells and whistles.

Read our blog post on choosing suitable software.

That’s it. Those are the bare minimum essentials for starting your own business as a tax preparer! Get off the ground before tax season and let us help you grow with education and tax practice management tools.

More Great Reads:

How To Start Earning Money As A Tax Preparer

5 Easy Ways To Establish Clientele As A New Preparer

source http://www.theincometaxschool.com/blog/tax-business-owner-essentials/