Sunday, December 31, 2017

Saturday, December 30, 2017

Friday, December 29, 2017

Why Tax Pros Shouldn’t Panic Over the New Tax Bill

While most Americans have been relaxing and enjoying the holiday season, the tax industry has been vigorously studying the new tax bill. Yes, there’s a still lot up in the air regarding how this coming tax season will go down but there’s one thing we know for sure: tax pros should not be worried about their professions.

Why Taxpayers Still Need Us

The tax law was touted to be simpler. In fact, there’s a rumor being spread that filing your taxes is as simple as filling out a postcard. Don’t worry tax preparers, that is just not the case. This new legislation is going to leave taxpayers in need of more advice than ever before. There are some very complex provisions that will require additional work when it comes to planning for the tax year.

For taxpayers and tax professionals, the new code means:

- New regulations.

- New tax planning strategies that businesses and individuals should get a jump on starting January 1st.

- Technical corrections to go over (Accounting Today points out that in their haste to get this bill passed, there’s no way they got everything right).

- The IRS has its hands full and will likely not be able to respond to everyone with a question about the new law.

- Business entities will need to take a look at how they’re structured.

Major change in an already complex industry means there will be a lot of questions and confusion. It will require professionals who know how to read the law and understand it.

CPAs Beware

The change in law has not been the best news for the Accounting industry thanks to the bill’s treatment of pass-through entities that are service based. According to AICPA president and CEO Barry Melancon, “While the tax reform legislation contains several provisions that should be welcomed by CPAs and their clients, the AICPA is very disappointed by lawmakers’ decision to exclude CPAs from the measure’s treatment of pass-through entities.” Unfortunately, the professional services sector will not qualify for the new deductions that were given to other businesses.

There are a lot of moving parts on the new legislation and its effects and unintended consequences are yet to be seen. All of this means that taxpayers and businesses will need your expertise and advice now more than ever.

We will keep you up-to-date as we get a handle on the new legislation. Stay tuned to our blog for updates and look for new education opportunities as well.

source https://www.theincometaxschool.com/blog/tax-professionals-new-tax-bill/

Thursday, December 28, 2017

Wednesday, December 27, 2017

Tuesday, December 26, 2017

Monday, December 25, 2017

Sunday, December 24, 2017

Saturday, December 23, 2017

Friday, December 22, 2017

Thursday, December 21, 2017

The Importance of Office Holiday Parties

There was a discussion on LinkedIn recently about attending or not attending the yearly holiday office party. These days it seems to be a badge of honor to skip it. Or, you go, but you dread it. Here’s the thing though. Holiday parties are important – especially if you’re an employer.

Whether you work for a large company or a small one, getting together to celebrate the season helps boost morale and teamwork. We have a holiday party every year that happens during work hours. The team gets a break during the day and we hang out, eat food, and pass out gifts. In addition to the “Secret Santa” gift exchange we did this year, my wife Marilyn and I bought two individual gifts for each employee.

Marilyn spent many hours shopping over the past 6 months and employees made food or dessert to contribute to the food provided by the company. I personally love getting together with my team – who are like family to me. But if you’re not convinced, here are some benefits to hosting/attending the holiday office party:

Marilyn spent many hours shopping over the past 6 months and employees made food or dessert to contribute to the food provided by the company. I personally love getting together with my team – who are like family to me. But if you’re not convinced, here are some benefits to hosting/attending the holiday office party:

- It’s an ideal opportunity to get to know people from other parts of your organization, or build stronger relationships with coworkers.

- It’s the last chance for a relaxing time before tax season (because 2018 just might be nuts!)

- It’s a team event so you’re kind of expected to attend. You know, as a team player.

- It can be an opportunity to network and be noticed by senior executives.

- It’s a thank you to employees for their hard work during the year.

- Non-attendance, without a valid excuse, may hold you in a bad light or be misinterpreted.

It’s only a couple of hours and you may actually end up having fun! I know our employees look forward to the holiday party each year. In fact, several employees commented how much they appreciated the gifts and being part of our team.

Happy Holidays everyone!

source https://www.theincometaxschool.com/blog/staff-holiday-parties/

Tax reform and alimony

|

| KPIX 5 December 20,2017 story by Mark Sayre |

2018," changes the tax treatment of alimony effective for divorce and separation agreements entered into after 2018. So, going forward for new instruments entered into after 2018, the payor of alimony gets no deduction and the conference report states that the recipient does not pick up income. Also, H.R. 1 removes "alimony and separate maintenance payments" from IRC 61(a) where it is currently listed as an example of gross income.

This has been proposed before, such as in H.R. 1 (113rd Congress), the Tax Reform Act of 2014 by former House Ways and Means Chairman Dave Camp.

This won't affect many taxpayers. Per IRS stats, less than 1% of individual returns report alimony received.

I was interviewed 12/20/17 for a news clip for KPIX-TV (CBS) by Mark Sayre, about this. You might enjoy it, don't miss my first statement.

What do you think about this change?

source http://21stcenturytaxation.blogspot.com/2017/12/tax-reform-and-alimony.html

Wednesday, December 20, 2017

Tuesday, December 19, 2017

Monday, December 18, 2017

Tax reform and timing of income

See Section 451 as modified by Sec. 13221 of H.R. 1 (also see information at the end of the document on links to the conference explanation and effective date information). The changes are to new subsections (b) and (c) and re-lettering of the subsequent subsections.

What do you think?

source http://21stcenturytaxation.blogspot.com/2017/12/tax-reform-and-timing-of-income.html

How Some Practices Achieve ROIs of 2,387% and Others Fail

The following article is a guest blog post by Joy Gendusa of Postcardmania.com

There’s ONE main factor which differentiates successful direct mail tax preparation campaigns from those that flounder and end up being a waste of money.

But before I tell you what that is, I want to show you 3 tax practice marketing campaigns from real clients of mine.

We keep track of successful campaigns when business owners share their results with us, so that we can use that data to help other business owners succeed at marketing.

We base all of our clients’ postcard designs (and campaign targeting) on our database of 2,000 tax clients’ marketing results collected from over 20 years in business. That way, we aren’t GUESSING what works — we’re only doing what we KNOW has worked based upon solid numbers.

These campaigns are all very different from each other, yet each one experienced incredible results with a return on investment of 1,422% and even 2,387%!

After you see these postcard designs and campaign numbers, I’ll give you my final take on them at the end.

CAMPAIGN #1

Mailing list: Local single-family residences with average annual incomes of $40,000 or more

Mailing schedule: 3,000 mailed twice with 1 week separating the mailings

Campaign results: 15 new clients, generating $2,000 in revenue

ROI: Lifetime revenue estimated at 597%

I love how the headline jumps out at you from the upper left hand corner. Who doesn’t want to get the MOST money back from their taxes?! Plus, blue communicates fiscal responsibility — another smart reason to call this practice!

CAMPAIGN #2

Mailing list: Residences with average annual incomes of $100,000 or more

Mailing schedule: 10,000 mailed one time

Campaign results: 265 responses, generating $60,000 in revenue

ROI: 1,422%

I love this design because it’s SO eye-catching. Plus, the bold headline really communicates to most people who want to be smart with their money (Don’t gamble with your taxes!) Not to mention a sweet 30%-off special offer… I’d call for that!

But, I saved the best for last…

CAMPAIGN #3

Mailing list: A house list of previous clients and current prospects

Mailing schedule: 2,500 mailed to just one time

Campaign results: 358 responses, 180 new clients, generating $62,000 in revenue

ROI: 2,387%

Here is a design that a client of ours provided and insisted on sending. While this is not a design that my creative department would ever compose for you, who can argue with $62,000 generated??

And although this postcard design may not win any design awards, it got the best results of all 3 because:

- They targeted people who knew and trusted them already

- They used a larger postcard (6”x 8.5” vs. 4”x6”)

- And they wrote their copy in Spanish for their clientele.

Did you notice anything about all 3 of these campaigns? It’s a bit of a trick question because each one is vastly different from the others, but here’s what I really want you to know:

KEY TAKEAWAY: There’s NO one-size-fits-all approach with your marketing. All of these campaigns were different, because they were tailored to that practice.

But here’s that ONE BIG TRUTH I promised at the beginning of the article that all of these campaigns have in common…

They did this:

Segment your market and target, target, target!

The truth is:

Your services can help everyone. We all have to file taxes. But a blanket approach may not be the best use of your marketing dollar.

PostcardMania has helped over 2,000 professional tax preparers and CPAs with their marketing, and what we’ve found from those who have had success is that targeting is the #1 differentiating factor between campaigns.

Here’s what else our proprietary data tells us:

There are 3 existing markets that work best for tax preparation targeting…

- High Income Consumers

- Low Income Consumers

- Your Client Data Base

And here’s what works best for each of those markets.

- High Income Consumers: This is the most difficult group to get a response from, but successful campaigns focus on a moderate discount and the quality of the tax preparation. Here are a couple good examples of what I mean:

- Messaging such as “get the guaranteed highest legal amount of deductions possible!”

- 15%-25% OFF Professional Tax Preparation

- Low Income Consumers: These consumers are the most price sensitive and respond better to higher discounts and offers, as well as refund-heavy messaging. Here’s a few ideas:

- Headlines like this one: “New tax laws have been passed —don’t miss out on new savings/deductions!”

- 25%-50% or $30 OFF Tax Preparation

- Scratch-offs also work well

- Client Data Base: Any of the above will work, depending on who your database consists of. Sending a reminder postcard to file taxes with you and a single offer will work well to reactive these consumers.

What’s important is that each campaign is appropriately targeted and timed.

If you’re targeting your own list but mailing through a USPS-certified bulk mail house like PostcardMania (because you can save on postage that way), make sure any mailing list vendor you work with scrubs your list of bad addresses and relocated consumers. You don’t want to waste marketing money on mailing to bad addresses.

If targeting new prospects and potential clients, it’s important to verify that your list provider ensures 90% deliverability on your postcards. If they aren’t willing to guarantee 90% of their addresses, it likely means that they don’t trust their list vendors — so why should you? At PostcardMania, we guarantee 90% deliverability AND refund you whatever amount over 10% is not deliverable.

I also advise that you work with a direct mail specialist directly. There are so many moving parts in a postcard campaign that it’s easy to get one wrong and blow your entire budget!

That is always one of my worst fears… a business owner finally tries postcards, gets it wrong and declares, “Postcards: been there, done that — they don’t work!”

That’s why PostcardMania works off of direct business owner consultations. We work with each of our clients personally to make sure every campaign is tailored to their business, their location and their ideal market.

If you really want to market above your competition, consider running coordinated ads online and on Facebook. This gives your prospects the perception that your tax practice is on-the-ball and EVERYWHERE — which is exactly what you want!

Because when your marketing reaches key prospects everywhere —

- in their homes with direct mail,

- on MILLIONS of websites worldwide with Google follow-up ads

- AND on their Facebook news feeds,

— your prospects won’t forget you anytime soon, and they’ll be MUCH more likely to choose you when they’re ready to file their taxes.

We can help you achieve this massive multi-platform marketing with our Everywhere Small Business program so you don’t have to lift a finger, but instead, you can focus on filing taxes and helping all your new clients.

Here’s what an Everywhere Small Business Campaign could look like for the second campaign above:

Regardless of whether or not you use PostcardMania, I want you to use this information to market your tax preparation services effectively!

That’s why I’ve shared all of PostcardMania’s own proprietary data with you — so you can use it to bring in new business and expand YOUR business. That is my ultimate goal, because small businesses growing and expanding helps all of us.

If you reach out to us, you’ll receive a personalized consultation tailoring your marketing campaign to your practice, your area, your goals, and your ideal clientele. And it’s FREE. There is no obligation to buy from us to receive this personalized consultation. I have 35 trained direct mail specialists that can assist you. Call them anytime at 855-549-1313.

You can also take a look at our gallery of tax preparation postcard designs for inspiration.

Here’s to a profitable and booming 2018!

source https://www.theincometaxschool.com/blog/direct-mail-roi/

Sunday, December 17, 2017

Saturday, December 16, 2017

Friday, December 15, 2017

2018 State Taxes Not Deductible in 2017

The answer, I believe, is no. At 12/31/17, you have no 2018 state tax liability because 2018 hasn't started yet. In contrast, if your property taxes were assessed in 2017 but you can pay them over installments in 2017 and 2018, you can pay the 2018 installment in 2017 and claim the deduction because it is truly a 2017 liability. Also, your fourth quarter estimated payment for your 2017 state income taxes is usually due 1/15/18, but can be paid in 2017. That is still fine and people will want to consider doing so, but must consider the 2017 AMT effect which might result in no tax benefit. That 4th quarter estimate needs to be reasonable. That is, you can't make a very large 4th quarter payment for 2017 knowing you'll get a refund of it in 2018 (see Revenue Ruling 82-208).

We have AMT in 2017 and for many individuals, they won't get a state tax deduction because they will owe alternative minimum tax where you don't get to deduct your state taxes.

For a great explanation of the tax technical reasons why individuals can't deduct 2018 state tax estimates in 2017, please see the following article by Kip Dellinger and Chris Hesse, CPAs:

source http://21stcenturytaxation.blogspot.com/2017/12/2018-state-taxes-not-deductible-in-2017.html

Thursday, December 14, 2017

Are You a Connector?

Have you heard of the philosophy “Givers Gain”? It’s a BNI principle based on the law of reciprocity. Networking should be an important part of your business. It’s a tried and true way to build your network, spread the word about your company, and essentially gain new clients.

You’ve likely encountered a number of different approaches to networking. Some people work the room in an attempt to get business cards in everyone’s hands, some people focus on meeting and talking to certain people, and some people just go with the flow. While there are different approaches to networking, there’s one approach we’ve found to be extremely effective – being a connector.

A connector is someone who always has a recommendation and is always willing to offer up an introduction to someone who might help your business grow. They have a huge network of people and are always willing to help.

Not only is helping people awesome. Helping other people helps you, because generally, those people will reciprocate your generosity.

5 Benefits of Being a Connector

1. You have a big network

Connectors are always developing relationships. They have a huge network of people which means LOTS of people know who they are and what they do.

2. You are THE person

When someone needs a referral, they come to you. That makes you a trusted advisor and someone who is always at the forefront of people’s minds.

3. “Givers Gain”

When you adopt a giving philosophy and focus on giving business to your fellow networkers, people naturally become eager to repay your kindness by sending business your way in return.

4. It makes networking easier

If striking up conversation makes you feel uneasy, take the connector approach. It’s easier to introduce two people who may not know each other but would be good connections for each other.

5. It’s good for you

Studies show that giving is good for the giver. It boosts your mental and physical health, it makes you more mindful and appreciative, and it’s fulfilling.

Try being a connect and you’ll reap the benefits!

source https://www.theincometaxschool.com/blog/be-a-connector/

Wednesday, December 13, 2017

Tuesday, December 12, 2017

Monday, December 11, 2017

Sunday, December 10, 2017

Saturday, December 9, 2017

Friday, December 8, 2017

Thursday, December 7, 2017

Wednesday, December 6, 2017

Tuesday, December 5, 2017

Monday, December 4, 2017

Sunday, December 3, 2017

Saturday, December 2, 2017

8 differences to be reconciled in House & Senate tax bills

It's alive! Tax reform, or at least tax cuts (for a while, for some people) survived a marathon session in the Senate, with that chamber approving its Internal Revenue Code revisions early Saturday, Dec. 2, morning.

Now the real fun begins.

Since the House version (H.R. 1, the Tax Cuts and Jobs Act) passed on Nov. 16 is different from the Senate's bill, the two legislative bodies must send members to a conference committee to mash up the two measures.

It won't be easy. While both the House and Senate bills cut corporate taxes and taxes on individuals, the bills diverge in some major areas.

Here are some of the biggest differences that have to be ironed out.

1. Tax rates and income brackets

Currently, we have seven progressive individual income tax rates and associated income brackets. They are 10 percent, 15 percent, 25 percent, 28 percent, 33 percent, 35 percent and 39.6 percent.The House wants to reduce those to just four individual rates — 12 percent, 25 percent, 35 percent and 39.6 percent — and income tax brackets, with the top tax kicking in on single filers who make more than $500,000 and more than $1 million for jointly filing married couples. That's much higher than the $418,401 for single filers and $470,701 for married joint filers at which the current 39.6 percent rate is imposed.

The Senate proposes keeping seven individual tax rates, but the highest tax it imposes on individuals is 38.5 percent, which applies to individuals earning more than $500,000 and married couples with combined income of $1 million.

The other six tax rates the Senate says would apply to us much less-wealthy filers are 10 percent, 12 percent, 22 percent, 24 percent, 32 percent and 35 percent.

On the corporate side, the House cuts the business tax rate from a nominal 35 percent to 20 percent starting in 2018. H.R. 1 also makes its individual and corporate tax rates permanent.

Under the Senate bill, the corporate tax rate also is cut to 20 percent and is permanent. It won't, however, drop until the 2019 tax year.

Meanwhile, individual tax cuts per the Senate would become law in 2018, but they would expire in 2025. The limited life span is so that the Senate can comply with its rule that tax changes don't create deficits beyond what is allowed under the approved budget amount.

2. Pass-through entities

Under this tax structure, income from certain businesses — such as sole proprietorships, partnerships, limited liability companies (LLC) and S-corporations — is passed through to the business owners, who then report it on their personal tax returns to be taxed at their individual ordinary tax rates.Both the House and Senate bills lower taxes on the business portion of a filer's pass-through income. But they do so differently.

The House bill cuts the top income tax rate for pass-through money to 25 percent from 39.6 percent. It also prohibits individuals who provide professional services, such as lawyers and accountants, from taking advantage of the lower rate. And it phases in a lower rate of 9 percent for businesses that earn less than $75,000.

Rather than setting a specific tax rate for pass-through income, the Senate bill lets such business owners deduct 23 percent of their income. Similar to the House bill, some service businesses would be prevented from taking the tax break; those making $250,000 if a single filer or twice that for married filing jointly couples could not claim the deduction.

3. Estate tax

The House bill would eliminate the so-called death tax beginning in 2024. Before the estate tax ends, the amount that could be left tax-free to heirs would double. Under current law for tax year 2017, that's $5.49 million per person or $10.98 per married couple.And heirs who sold shares of stocks they were left would not have to pay any capital gains tax on the proceeds.

Rather than repeal the estate tax, the Senate increases the amount that can passed tax-free to loved ones and friends from the current nearly $5.5 million to $11 million.

4. Alternative Minimum Tax

The House bill repeals the Alternative Minimum Tax, or AMT. This parallel tax system was created to guarantee that the richest tax filers pay at least some tax. Despite changes to ease its effect on more middle-income taxpayers, many still are hit by this bipartisanly hated tax.The Senate also wanted to kill the AMT, but budget considerations forced the Upper Chamber to retain the tax. The Senate bill does, however, increase the amount of income exempt from the AMT.

5. Mortgage interest and other home-related deductions

The House bill keeps, but reduces for new buyers, the amount of mortgage interest that can be claimed as an itemized deduction. H.R. 1 would let borrowers deduct interest on up to $500,000, half the loan amount allowed under current law.The Senate basically leaves the maximum mortgage interest deduction alone. Keeps the mortgage interest deduction for a filer's main home as is, letting homeowners claim a deduction for the interest paid on home loans up the $1 million for their primary residences.

As for property taxes, another now fully deductible home-related expense, both the House and Senate tax bills would limit the amount of real estate taxes that could claimed by itemizers to $10,000.

The bills also change how homeowners can profit tax-free from the sale of their residences.

Current law allows sellers to generally exclude $250,000, or $500,000 for those filing jointly, from capital gains when selling their primary residence as long as they've lived in it for two out of the past five years. Both the House and Senate want to increase the live-in time period to five out of the last eight years.

The Senate bill also ends the deduction for home equity loans.

6. Child tax credit

Parents and guardians currently can claim a tax credit of $1,000 for each dependent child younger than 17.The House bill would increase the credit to $1,600 per child.

The Senate's child tax credit would increase to $2,000 per child. It also would be available for any children younger than 18, but would revert to the 17-year-old limit in 2025.

Both versions would be subject to income phaseouts.

Opponents of both bills say that since the child tax credit is only available to parents who pay income taxes, more than 10 million children in low-income families would be excluded from the increased tax break.

7. Other deductions and credits

The House and Senate bills agree on eliminating the itemized deductions for state and local income and state and local sales taxes.While these components of the of the various deductible state and local taxes, known in the tax world by the acronym SALT, were approved by their respective chambers, expect opponents of the change — including some Republican House members — to fight the SALT elimination provisions again in any conference version.

The House bill originally got rid of the adoption tax credit, but added it back in after objections from some GOP lawmakers. The Senate bill would leave the adoption credit in the tax code.

Both bills also eliminate the above-the-line deductions for student loan interest and moving expenses, as well as the itemized one allowed under miscellaneous expenses for tax preparation fees.

And then there's the medical tax deduction.

Current tax law allows Americans to deduct as itemized expenses qualified medical costs that come to more than 10 percent of a taxpayer's adjusted gross income (AGI). This can include a variety of medical expenses above and beyond just the standard doctor, dental and vision expenses. It is a tax breaks especially used by people with chronic illnesses.

The House bill repeals the medical deduction option. The Senate bill, however, keeps it and goes back to the prior 7.5 percent of AGI threshold that was increased as part of the Affordable Care Act.

8. Affordable Care Act individual mandate

And about the ACA, or Obamacare as it's still popularly known, has come back into play in the tax reform debate.Originally, the House and Senate wanted to repeal it and its many taxes to free up money to make tax cuts easier from a budgetary standpoint. That didn't happen.

But a part of the health care law has been worked into the Senate tax reform bill. Or rather, worked out of the tax code.

The Senate's bill would repeal the ACA's individual mandate. This is the health care law's requirement that individuals buy at least a minimally acceptable medical insurance policy or pay a tax penalty for going without coverage.

The House keeps the Obamacare insurance coverage requirement on the books.

However, House Speaker Paul Ryan (R-Wisconsin) last month said that if the Senate took the lead on scrapping the health care coverage requirement, he's open to adding similar language to any final tax reform measure.

If Ryan sticks with that stance, the ACA issue could be one of the easier provisions that conference committee members will tackle. However, they could get push pack similar to that they faced during their chambers' specific Obamacare repeal efforts, especially since the CBO says that striking the ACA mandate will mean 13 million more Americans would be uninsured by 2027.

Much tax reform work left to do: The bottom line is that there is still a lot of work to be done before we get any tax bill. And it won't be easy.

The Senate bill is 479 pages long, with many changes made — some of them by nearly illegible scribbling in the bill's margins — at the last minute as the final vote neared.

That process infuriated a lot of Senators, and by a lot I mean all 46 Democrats and two Independents.

Their frustration was summed up by Democratic Sen. Jon Tester of Montana who took to Twitter last night to exasperatedly complain, "I was just handed a 479-page tax bill a few hours before the vote. One page literally has hand scribbled policy changes on it that can’t be read. This is Washington, D.C. at its worst. Montanans deserve so much better."

I was just handed a 479-page tax bill a few hours before the vote. One page literally has hand scribbled policy changes on it that can’t be read. This is Washington, D.C. at its worst. Montanans deserve so much better. pic.twitter.com/q6lTpXoXS0

— Senator Jon Tester (@SenatorTester) December 2, 2017

Yep, the Treasure State's senior senator lived up to his surname in his testy nailing of the problem with the way Congress, and the Senate in particular last night/early this morning, has operated when it comes to controversial legislation.

Math, not massive size of bill, at issue: Maybe members of Congress will get/take time to read the massive Senate tax bill and carefully compare it to the House version before any final decisions are made in the upcoming conference committee deliberations.

But the biggest obstacle is not legislative language. It's budget math.

The CBO estimates that the House bill will increase the deficit past the initial 10-year window. That's a no-go as far as Senate rules are concerned.

The Senate cannot approve tax measures that that increase the deficit over the coming decade. Per the recently passed budget resolutions, that's $1.5 trillion over that period. Late Friday as Senators were debating their tax bill, the CBO released its analysis finding that the Senate proposal would increase the deficit by $1.4 trillion over the next decade.

Whew! Just sneaked in under the budget line.

The Senate got to the acceptable deficit amount by using the sunset gimmick that ends almost all individual tax breaks at the end of 2025 so that the corporate tax break can become permanent parts of the Internal Revenue Code.

Any changes that are made in the tax reform bill conference committee will have to take the Senate deficit requirements into account to assure that a final bill can make it through that chamber. Again.

Tax reform is ____: Hunker down, folks. This ride is far from over.

To borrow Donald J. Trump's observation during the failed Obamacare repeal and replace effort, who knew tax reform could be so hard?

Or, per my witty Twitter tax pal Joe Kristan in deciphering the #TRIH hashtag, it also is many other things:

Let me add one more: Hypocritical.

source http://www.dontmesswithtaxes.com/2017/12/tax-reform-key-differences-in-house-and-senate-bills.html

Friday, December 1, 2017

Thursday, November 30, 2017

IRS Tips for Holiday Security

The IRS wants to remind holiday shoppers to remain vigilant with their personal information this  holiday season. That means you should be communicating with clients to ensure they stay vigilant this December. In the hustle and bustle of finding the best deals and shopping for everyone on your list, cybercriminals are waiting. While you’re shopping for presents, they’re shopping for credit card numbers, financial account information, Social Security numbers and other sensitive data that could help them file fraudulent tax returns.

holiday season. That means you should be communicating with clients to ensure they stay vigilant this December. In the hustle and bustle of finding the best deals and shopping for everyone on your list, cybercriminals are waiting. While you’re shopping for presents, they’re shopping for credit card numbers, financial account information, Social Security numbers and other sensitive data that could help them file fraudulent tax returns.

The IRS has declared this week “National Tax Security Awareness Week”.

“Cybercriminals seek to turn stolen data into quick cash, either by draining financial accounts, charging credit cards, creating new credit accounts or even using stolen identities to file a fraudulent tax return for a refund.” – IRS Press Release

Here are seven steps to share with clients courtesy of the IRS that will help with online safety and protect tax returns and refunds in 2018.

- Shop at familiar online retailers. Generally, sites using the “s” designation in “https” at the start of the URL are secure. Look for the “lock” icon in the browser’s URL bar. But remember, even bad actors may obtain a security certificate so the “s” may not vouch for the site’s legitimacy.

- Avoid unprotected Wi-Fi. Beware purchases at unfamiliar sites or clicks on links from pop-up ads. Unprotected public Wi-Fi hotspots also may allow thieves to view transactions. Do not engage in online financial transactions if using unprotected public Wi-Fi.

- Learn to recognize and avoid phishing emails that pose as a trusted source such as those from financial institutions or the IRS. These emails may suggest a password is expiring or an account update is needed. The criminal’s goal is to entice users to open a link or attachment. The link may take users to a fake website that will steal usernames and passwords. An attachment may download malware that tracks keystrokes.

- Keep a clean machine. This applies to all devices — computers, phones and tablets. Use security software to protect against malware that may steal data and viruses that may damage files. Set it to update automatically so that it always has the latest security defenses. Make sure firewalls and browser defenses are always active. Avoid “free” security scans or pop-up advertisements for security software.

- Use passwords that are strong, long and unique. Experts suggest a minimum of 10 characters but longer is better. Avoid using a specific word; longer phrases are better. Use a combination of letters, numbers and special characters. Use a different password for each account. Use a password manager, if necessary.

- Use multi-factor authentication. Some financial institutions, email providers and social media sites allow users to set accounts for multi-factor authentication, meaning users may need a security code, usually sent as a text to a mobile phone, in addition to usernames and passwords. For added protection, some financial institutions also will send email or text alerts when there is a withdrawal or change to the account. Generally, users can check account profiles at these locations to see what added protections may be available.

- Encrypt and password-protect sensitive data. If keeping financial records, tax returns or any personally identifiable information on computers, this data should be encrypted and protected by a strong password. Also, back-up important data to an external source such as an external hard drive. And, when disposing of computers, mobile phones or tablets, make sure to wipe the hard drive of all information before trashing.

In addition to these tips, encourage your clients to check their credit reports from each of the three major credit bureaus to ensure there aren’t any unfamiliar credit changes. Consumers can also create a “My Social Security” account online with the Social Security Administration to see how much income is attributed to their SSN. This can help determine if someone else is using your SSN for employment purposes.

As tax preparers, it’s our duty to keep clients informed to help prevent tax fraud and identity theft. Be a source of comfort and information by keeping your clients informed all year long. Reminding them of cybersecurity best practices is just one way to prevent a disaster come tax time.

source https://www.theincometaxschool.com/blog/irs-holiday-security-tips/

Wednesday, November 29, 2017

Tuesday, November 28, 2017

Monday, November 27, 2017

Sunday, November 26, 2017

Saturday, November 25, 2017

Friday, November 24, 2017

Thursday, November 23, 2017

Wednesday, November 22, 2017

Thankful for Our Family Business

Photo credit: Richmond Times Dispatch.

The Income Tax School is a nationwide online tax school that serves thousands of tax professionals and students each year. While that takes an entire team of employees to run, at its core both The Income Tax School and Peoples Tax are a family business.

It didn’t start out as a family business, but it evolved into being one. Way back when, my then fiancee (now wife) Marilyn lent me $60 to take my first tax class. That class got me a job as a seasonal tax preparer at H&R Block, which led to becoming their Mid-Atlantic regional director and then the New York City regional director. In 1987, I opened Peoples Income Tax, and in 1989 after seeing a need for quality tax education, I opened The Income Tax School to provide turn-key kits enabling independent tax business owners nationwide to operate their own tax schools. Then, to be able to teach students directly nationwide, I launched elearning courses in 2003.

About 18 years ago, my daughter Terry joined the company and is now our Marketing Director. A few years after that, my wife Marilyn joined us as our Vice President of Human Resources. Terry and Marilyn complement me and, together, we make a great top management team that is totally committed to the success of the company. Without Marilyn and Terry, I don’t think the business would have survived the many challenges we have encountered and overcome together.

In addition to my family, our company has hired relatives of several employees, which has increased the family nature of our business.

This year, as I think about the things I am thankful for, I am most thankful for my family and our family business and everyone’s commitment to our success. I hope you have a wonderful Thanksgiving holiday!

source https://www.theincometaxschool.com/blog/thankful-for-our-family-business/

Tuesday, November 21, 2017

Monday, November 20, 2017

Sunday, November 19, 2017

Saturday, November 18, 2017

Friday, November 17, 2017

Thursday, November 16, 2017

Wednesday, November 15, 2017

Thankful for Our Family Business

The Income Tax School is a Nationwide online tax school that serves thousands of tax professionals and students each year. While that takes an entire team of employees to run, at its core both The Income Tax School and Peoples Tax are a family business.

It didn’t start out as a family business, but it evolved into being one. Way back when, my then fiancee (now wife) Marilyn lent me $60 to take my first tax class. That class got me a job as a seasonal tax preparer at H&R Block, which lead to becoming their Mid-Atlantic regional director and then the New York City regional director. In 1987, I opened Peoples Tax, and in 1989 after seeing a need for quality tax education, I opened The Income Tax School to provide turn-key kits enabling independent tax business owners nationwide to operate their own tax schools. Then, to be able to teach students directly nationwide, I launched elearning courses in 2013.

About 18 years ago, my daughter Terry joined the company and is now our Marketing Director. A few years after that, my wife Marilyn joined us as our Vice President of Human Resources. Terry and Marilyn complement me and, together, we make a great top management team that is totally committed to the success of the company. Without Marilyn and Terry, I don’t think the business would have survived the many challenges we have encountered and overcome together.

In addition to my family, our company has hired relatives of several employees, which has increased the family nature of our business.

This year, as I think about the things I am thankful for, I am most thankful for my family and our family business and everyone’s commitment to our success. I hope you have a wonderful Thanksgiving holiday!

source https://www.theincometaxschool.com/blog/thankful-for-our-family-business/

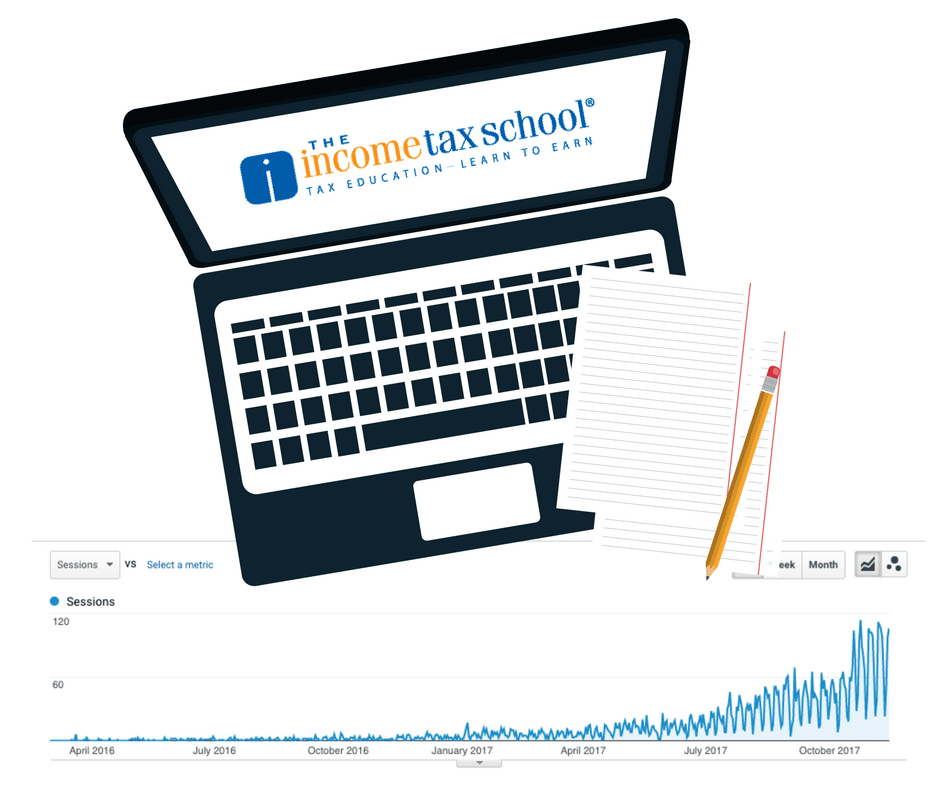

How One Blog Post Generated Thousands of Hits

Last year we wrote a blog post on the Peoples Tax blog (our sister tax preparation company) with line by line explanations on filling out a W4. Each month, no matter what we write about, this blog is the most visited page on our website. In fact, since we posted it in March of 2016, it has received 7,704 visits!

This blog is just a testament to how unsure people are about their tax situation. Sometimes questions that seem the most basic to us, are the very same questions our clients are asking. As a tax professional, it just goes to show that:

- No matter what, there will always be taxpayers who need our guidance.

- You should not only be blogging, you should answering these popular questions on your blog!

Generally speaking, when people need an answer to their question, the first place they go is the internet. Our traffic to this blog post is overwhelmingly coming from Google searches. So, how can you have the same success? Do your research to uncover the big questions your target audience is asking and write about it.

You can do that a few ways:

- Ask clients, contacts, LinkedIn Group members, or your social media followers.

- Research what taxpayers are asking in online forums like reddit.com/r/tax or Quora.

- Check out tools like Google’s Keyword Planner or BuzzSumo.

Blogging is a great way to drive traffic to your website and establish your voice as a subject matter expert. For more on blogging, check out these posts:

Why Your Tax Firm Should Have A Blog

Social Media Guide for Tax Business Owners

If you want a fool proof blueprint to marketing your tax business, check out our Tax Business Marketing Manual.

source https://www.theincometaxschool.com/blog/tax-pro-blog-post/

Tuesday, November 14, 2017

Monday, November 13, 2017

Sunday, November 12, 2017

Saturday, November 11, 2017

Tax Reform - What's Up?

A few observations:

- The House calls for individual rates of 12%, 25%, 35%, 39.6% and a surtax on the top rate because the benefit of the 12% bracket will phase-out for those in the top bracket (over $1 million of income).

- The Senate rates are 10%, 12%, 22.5%, 25%, 32.5%, 35% and 38.5%.

- Both change the corporate rate to a flat 20% (rather than today's top rate of 35%). The Senate delays this rate until 2019.

- Both bills reduce the maximum rate on business income of passthrough entities, other than professional service firms, but in different ways, and both with some complexity!

- The standard deduction in increased with most itemized deductions other than mortgage interest and charitable contributions remaining. The Senate retains the medical expense deduction.

- Personal and dependency exemptions are repealed. Both bills have a higher child credit amount and a credit for non-child dependents ($300 in House and $500 in Senate).

- Increased expensing amounts for limited time periods.

- Section 199 is repealed.

- Section 1031 would only apply to real property (other than dealer property).

- The estate tax exemption is doubled. The House repeals the estate and GST after 2023; the Senate does not.

- The corporate system is moved to a territorial system with provisions to prevent base erosion.

- What all will be temporary due to reality that this will be enacted via budget reconciliation so only 51 votes needed in Senate rather than 60. But bill cannot increase deficit after ten years.

- Anything new to be added to help reduce cost, if necessary.

- Whether simplification is possible. While many individuals will move from itemizing to taking the standard deduction, there are still a variety of complex provisions for individuals and busiensses.

source http://21stcenturytaxation.blogspot.com/2017/11/tax-reform-whats-up.html

Friday, November 10, 2017

Are You Investing In Your Employees?

Your employees are the heart and soul of your business. They keep your clients happy and they keep operations running. It’s important to make sure that you take care of them. Not only do happy employees make for happy clients, it’s expensive to hire and train. So, keeping your turnover low is extremely advantageous. Here are some great ways to invest in your employees so that they continue to grow and be successful at your firm.

Help them find their own niche

Becoming a specialist in one area of tax is a great way to zero in on specific clients and earn their trust. Think about it. If you have curly hair, you want to go to a hairdresser that specializes in curly hair. If you’re in the mood for pizza, you don’t want to go to a random restaurant that happens to have pizza on their menu, you want a place that makes pizza.

Did you know? 25% of employees would be more satisfied at work if they were given the opportunity to do what they do best.

If there’s an area of tax law that an employees seems to be particularly interested in, why not let them specialize in it by offering to pay for CE Courses online?

We’ve written about becoming a specialist before. Check out the blog post below.

Become Enrolled Agents

It’s not that hard to gain the knowledge and expertise to prepare taxes for the general public, just look at the national tax firms turn and burn employees each tax season. Being an Enrolled Agent is the highest credential there is in the tax industry, which hold a lot of weight! Wouldn’t you rather have tax preparers who can better serve clients, charge more for their services, and promote as experts? Invest in your employees by putting on the path to Enrolled Agent.

Spend time on initial training

The on-boarding and training process of a new employee is crucial to retention. Investing in your staff means investing time to train them properly. That goes beyond making sure they prepare taxes properly. It includes knowing the policies and procedures, ongoing and upcoming promotions and you customer service standards.

Did you know? 40% of employees who receive poor job training leave their positions within the first year.

Professional Development

Being a successful tax preparer involves networking and relationship building. Your tax preparers need to get out of the office during the slow season to network, build relationships, and have opportunities for professional development. Whether it’s the occasional Lunch & Learn offered by a local or national association or a seminar, you should make sure that your employees are developing their professional skills and increasing their network.

Finding fun ways to acknowledge their hard work

Finally, beyond continuing education and professional development you’ve got to learn to have fun. Celebrate successes, acknowledge hard work, and create a workplace that your staff is excited to come to each day. It doesn’t take much. Here at The Income Tax School we host holiday parties, have ice cream socials, and even have a “fun committee” for planning fun activities.

Turn over is expensive. The best practice is to hire good employees and then invest in their development.

source https://www.theincometaxschool.com/blog/invest-in-your-employees/

Thursday, November 9, 2017

Wednesday, November 8, 2017

Tuesday, November 7, 2017

Monday, November 6, 2017

Sunday, November 5, 2017

Saturday, November 4, 2017

Friday, November 3, 2017

Thursday, November 2, 2017

Time to Set Year-End Tax Planning Appointments

The holidays are quickly approaching – which for the tax industry means year-end tax planning should be on your radar. Have you reached out to clients yet? It’s important that both individual and business clients consult with you to make tax moves that could positively affect their tax bill come tax season.

Here are some important year-end reminders and strategies.

New Tax Laws in 2017

For higher income taxpayers ($418,400 taxable income for singles, $470,700 for married filing joint, $444,550 for heads of households and $235,351 for married filing separate), the 2017 tax year brought increased income thresholds.

Starting January 1st, The Protecting Americans from Tax Hikes (PATH) Act kicked in. This law requires the IRS to wait until February 15th to send out credits and refunds when the Earned Income Tax Credit (EITC) or the Additional Child Tax Credit (ACTC) is claimed on a return. This could affect your cash flow.

On the healthcare front, limits for Medical Savings Accounts increased by $50 this year. The maximum deductibles for out-of-pocket expenses are $4,500 for self-only coverage and $6,750 for family coverage. The minimum deductible amount for annual family coverage is $4,500. The limit on out-of-pocket medical expenses under family coverage ($8,250) increases by $100.

For those who waited to get healthcare coverage hoping that Obamacare would be overturned, they will have to pay a penalty. One of the aspects of the ACA that IRS was tasked with enforcing is the individual mandate. The fee is calculated 2 different ways – as a percentage of your household income, and per person. You’ll pay whichever is higher.

- Percentage of income

- 2.5% of household income

- Maximum: Total yearly premium for the national average price of a Bronze plan sold through the Marketplace

- Per person

- $695 per adult

- $347.50 per child under 18

- Maximum: $2,085

For Seniors looking to claim a deduction on their medical expenses when itemizing, this year is a bit different. Qualified medical expenses must be greater than 10% of your adjusted gross income (AGI). This is up from 7.5% in 2016.

Year-End Tax Strategies

Here are some traditional, end of year tax strategies to remind your clients about.

Income Deferral

Income deferral strategies shift income to the following tax year. If you expect to be in the same or a lower tax bracket in 2018, it may be advantageous to defer some of your income or accelerate deductions into the current year.

- Self-employed, cash basis taxpayers can delay billing clients until late in the year so that they will not receive the payments until 2018.

- Try to convince your employer to consider paying bonuses in January rather than December.

- Delay selling stocks with capital gains (unless they can be offset with losses)

- Sell stocks that are in a losing position to reduce income this year.

- Delay IRA or retirement account distributions. If you are 70 ½ don’t delay the required minimum distribution.

- Convert taxable compensation into tax free fringe benefits such as negotiating to receive an incentive stock option in place of some salary. Exercising the ISO does not produce taxable income for regular tax or the surtax, but is taxable for alternative minimum tax purposes.

Deduction Acceleration:

- Pay tax deductible expenses before the end of the year. Consider using a credit card which will conserve your cash but allow the deduction in this year.

- Maximize 401(k) and IRA contributions. Don’t forget catch-up contributions.

- If you are self-employed set up a self-employed retirement plan.

- Make qualified charitable donations (QCDs) from your IRA. If you are at least 70 ½ contributions to IRS approved charities made directly from your IRA to the charity can be used to satisfy the minimum required distribution rules but are tax free to you.

- Consider asking your employer to increase your state tax withholding now if you expect to owe state taxes when you file your return to accelerate the deduction into 2017.

- If you elect to deduct the sales taxes rather than state income taxes on your Schedule A, accelerate large purchases such as automobiles or boats into the current year in order to take advantage of the sales tax deduction

Individual Taxpayers

-

- State and local sales and use tax deduction: Taxpayers were allowed to deduct the larger of sales and use taxes or state or local income taxes paid. This provision has been particularly beneficial to retired individuals who did not have state tax withholdings during the tax year.

- Qualified Charitable Distributions: IRA owners or beneficiaries who are 70 ½ or older were permitted to make cash contributions from their IRA accounts of $100,000 or less to IRS recognized charities.

- Charitable Contributions: Now is a good time to clean out closets, attics, basements, and storage containers to donate unused items to qualified charitable organizations. Be sure to make a list of the items you donated with brief descriptions and the the fair market value of each item. Taking pictures of your donations is also helpful in substantiating your donations. Donated items must be in good or better condition to be deductible. Remember to get a receipt or written acknowledgment of all donations.

- Mortgage Insurance Premiums (PMI) deductions as qualified residence interest will expire.

- Standard Deduction vs. Itemized Deductions: Before itemizing deductions, taxpayers should calculate the federal and state tax returns using both the itemized and standard deduction to determine which is more beneficial overall. Itemizing deductions can have a negative impact on the state return, depending on the allowed state standard deduction. For instance, if a large portion of the taxpayer’s itemized deductions are state incomes tax withheld, the state return would be greatly impacted since most states don’t allow the state income tax withheld as an itemized deduction.

- Check Withholdings: Taxpayers should take time to check their withholdings to determine if they’ve withheld enough federal and state taxes during the year. If the taxpayer is at risk for having a balance due, he can increase the amount withheld from his wages. He can also make an estimated payment to decrease or completely offset the expected balance due.

Business Taxpayers

- Business taxpayers will continue to be allowed to claim the 50% bonus first-year depreciation deductions (for tax years 2015-2017). The maximum deduction limit for Section 179 property purchased and placed in service in is $510,000. The limit is reduced by the amount of the cost of Section 179 property placed in service during 2017 that exceeds $2,030,000.

- If you own an S corporation or a partnership consider increasing your basis in order to deduct a loss this year or suspended losses from prior years.

- The business standard mileage rate for 2017 is 53.5 cents per business mile. Keep accurate business mileage logs to ensure you are receiving the largest legitimate mileage deduction allowable.

- Keeping accurate and up-to-date business records ensures the business will benefit by deducting the maximum legitimate expenses allowed for businesses. Sloppy recordkeeping is very costly to businesses at tax time.

Please Note: If tax reform is enacted by Congress, the changes could be made retroactive to January 1, 2017, which could eliminate a number of deductions and make itemizing unnecessary for many taxpayers. This would require changes in year-end tax planning strategies, your cash flow, and that of your EITC clients.

source https://www.theincometaxschool.com/blog/2017-year-end-tax-planning/

Wednesday, November 1, 2017

Tuesday, October 31, 2017

Monday, October 30, 2017

Sunday, October 29, 2017

Saturday, October 28, 2017

Friday, October 27, 2017

Thursday, October 26, 2017

Wednesday, October 25, 2017

Tuesday, October 24, 2017

Monday, October 23, 2017

Sunday, October 22, 2017

Saturday, October 21, 2017

Friday, October 20, 2017

Thursday, October 19, 2017

Tax Preparers Beware: Cybercriminals Are Out to Get You

Cybercriminals are targeting a new group lately: tax preparers. Cybercrime has become serious business in the past few years as new, more sophisticated scams crop up. Cybercriminals have realized – why target one tax payer when you can breach an entire tax office or single tax preparer and hundreds of taxpayer identities?

in the past few years as new, more sophisticated scams crop up. Cybercriminals have realized – why target one tax payer when you can breach an entire tax office or single tax preparer and hundreds of taxpayer identities?

Be wary of these top tax preparer scams.

Fake Insurance Tax Form Scam

The Insurance Tax Form Scam is the newest of the scams targeting tax preparers. This one is pretty complex. According to the IRS, here’s how the scam works:

“The cybercriminal, impersonating a legitimate cloud-based storage provider, entices a tax professional with a phishing email. The tax professional, thinking they are interacting with the legitimate cloud-based storage provider, provides their email credentials including username and password.”

Once they have access to your account, they steal your client’s email addresses and impersonate you by sending emails to your clients. In the email, they attach a fake IRS insurance form and request that the form be completed and returned.

The subject line and email is usually a variation of the following:

“urgent information”

Dear Life Insurance Policy Owner,

Kindly fill the form attached for your Life insurance or Annuity contract details and fax back to us for processing in order to avoid multiple (sic) tax bill (sic).

E-Services Scam

This phishing scam asks tax preparers to “sign a new e-Services user agreement.” The email will claim to be from the “e-Services Registration” and uses “Important Update about Your e-Services Account” in the subject line. It states that e-Services is rolling out a new user agreement that all users must accept. The tax preparer is directed to a fake website where they are prompted to review and accept the new agreement.

Software Scam

This scam involved impersonating popular software service providers. The subject line is everything from “Software update” to “account shutdown”. The body of the email is generally the same – the scammer wants you to “validate” or “re-authenticate” your login credentials but clicking on their phony link and entering in your username and password.

Scammers are getting very good at mirroring other company’s websites and emails. The email address, at a glance can look legitimate but if you look closer there’s usually something off about it. Maybe it’s there one letter that’s different or maybe the domain name is .net instead of .com.

Once your credentials are stolen, cybercriminals steal your client information to either file fraudulent returns or steal identities.

Taxpayer Impersonation

This scam is a two-step process. First, the tax preparer receives an email seemingly from a taxpayer looking for tax preparation services. Once you respond to the first message, a second email comes with an embedded web address or a PDF attachment that has an embedded web address. You think you’re downloading a potential client’s tax information when in reality your credentials are being stolen.

Be very careful when it comes to unsolicited emails seeking your services. Never respond to or click on a link in an unsolicited email or PDF attachment from an unknown sender.

There are just a few examples of the seemingly endless attempts at stealing taxpayer information. If you suspect a scam, be sure to contact phishing@irs.gov.

Cybersecurity Best Practices

Make cybersecurity an everyday practice by following these tips.

- Be careful of email attachments and web links.

- Use separate personal and business computers, mobile devices and accounts.

- Do not connect personal or untrusted storage devices or hardware into computers, mobile devices or networks.

- Be careful downloading software.

- Watch out when providing personal or business information.

- Watch for harmful pop-ups.

- Use strong passwords.

- Conduct online business more securely.

For more on cybersecurity in the tax industry, check out our IRS Don’t Take the Bait Series Recap. Also, be sure to follow our Tax Scam Roundup. We add to it as new scams pop-up.

source http://www.theincometaxschool.com/blog/tax-preparers-beware-cybercriminals-are-out-to-get-you/

Tuesday, October 17, 2017

Monday, October 16, 2017

Sunday, October 15, 2017

Saturday, October 14, 2017

Friday, October 13, 2017

Thursday, October 12, 2017

Tax Reform Issues

|

| Speaker Ryan explaining tax reform at 10/4/17 Facebook Event, holding the postcard form (see my comment below though) |

On 10/10, Speaker Ryan noted 5 ways that tax reform will save people taxes in 2018. Each seems correct, but each has uncertainty connected with it because we don't have legislative language yet or hides that the framework, despite suggestions of modernization, doesn't fully modernize our tax system. Here are his five items:

1. Bigger standard deductions - He says it will be "nearly doubled." The framework indicates, for example, that the standard deduction for a single person will be $12,000. It is $6,300 today. What he doesn't say though is that the personal and dependency exemptions go away. Today, that's $4,050 per person. While the child credit is supposed to increase and apply to more families, today, it only applies to children under age 17 while the dependency exemption can cover some children up to age 23. So, not enough details yet to indicate that any individual paying income tax today will see lower income taxes in 2018, particularly if they have a few children and lose itemized deductions that would have been larger than the new standard deduction.

2. Lower individual rates - The framework suggests rates of 12%, 25% and 35% and perhaps a higher rate for high income individuals. Today, the lowest rate is 10%. Actually, the lowest rate today and under the plan is 0%. If someone today has income too low to pay income taxes, that should continue under the framework. These folks - about 45% of individual filers, won't see bigger paychecks. There is no talk of lowering the 15.3% payroll tax. Some of these zero bracket filers might be getting a larger refundable child credit, but they won't see that until they file their tax return. Also, we don't know where the rate brackets start and end so we don't know for sure if everyone drops income into lower rates.

3. Capped rate on small business of 25% - Leading up to the release of the framework, there was talk that this would not apply to all businesses and perhaps some personal services, such as accounting, would not get the cap. Again, depending on where the individual rates start and end, most small business owners should not be in the 35% rate because they are not today. [TaxProToday, 9/13/17]

4. Immediate write-offs for business investments - The framework suggests allowing expensing of capital investments. Ideally, this would also include intangibles and both acquisition of new and used depreciable property. Details are missing.

5. Increased child tax credit - Apparently, this is to adjust for repeal of the dependency exemption. The dependency exemption though can apply to more than your child. Also, the current child credit covers a narrower age range than the dependency exemption.

Speaker Ryan also notes that if compliance costs go down, that is also a tax cut. I'm not sure we'll see a significant drop in compliance costs. There are still complexities such as the child tax credit and hopefully, the Earned Income Tax Credit remains. Promotion of IRS VITA sites and other low-income tax preparation clinics would help keep compliance costs down for many.

Caution - A postcard size return doesn't say anything about the complexity level of a system. We could file on postcards today if the IRS would take less information on the components of our taxable income. The postcard in the Republican blueprint of June 2016 didn't have a place to sign or a penalty of perjury statement or information about the taxpayer or where to deposit any refund. AND, why are we modernizing our tax system to fit on a postcard rather than to use today's technology to not even have to file for most people because the system already has enough information to just sent a bill or deposit the overpaid taxes in your account or send you a secure debit card?

There is a lot of good about tax reform and it would be good to hear more about that rather than claims that don't seem completely accurate or complete. And there is a lot of information often missing such as the effect on the deficit and debt, distribution of the tax cuts among different income levels, transition, timing, and more. Speaker Ryan's 10/10 post includes a video of him explaining the tax system and notes many good ideas, we just need to be critical listeners and watch for missing pieces.

source http://21stcenturytaxation.blogspot.com/2017/10/tax-reform-issues.html