Finding a career path can be hard if you or your spouse is in the military. You never know when your schedule is going to change or when you’re going to have to relocate. When both your schedule and location is at the whim of someone else, your options can be limited.

In our 30+ years of teaching tax preparation and running a tax preparation business, we’ve found that tax preparation is a great career for military members, veterans, and their spouses! Here are 5 reasons why:

- It’s portable.

- You have flexibility.

- It’s an affordable fast track to a professional career.

- It has high income earning potential.

- There’s a military discount!

You Can Do It From Anywhere

For military members and their spouses, relocation is inevitable. Finding a job or career you can take with you is not always easy to come by. Tax Preparation is a great option because of the portability! You can be a tax preparer anywhere – wherever there are U.S. taxpayers, there is a need for tax preparers. That includes bases overseas.

If you’re a military spouse, a great way to start getting clients is to offer your services at the military base and then expand your client list from there. Tax clients typically continue to ask their tax preparers to do their returns remotely if they or their tax preparer relocates. Remote tax preparation is very easy using the Internet, phone and e-mail. Real-time interviews can also be conducted by web-cam, Skype, or FaceTime.

You Have Flexibility (+ Summers and Holidays Off!)

Since most tax preparation offices are open days, evenings and weekends, tax preparers have options when it comes to schedules. If you decide to go out on your own, you can choose your own hours as well. In addition to the flexible schedule, many tax preparers also have their summers off and don’t work on major holidays since tax season is mid-January through mid-April. This works great for military spouses with children at home in the summer months and holiday breaks! This is also great for retired military and veterans who no longer can/want to work full-time and/or year-round.

Fast Track to a Professional Career

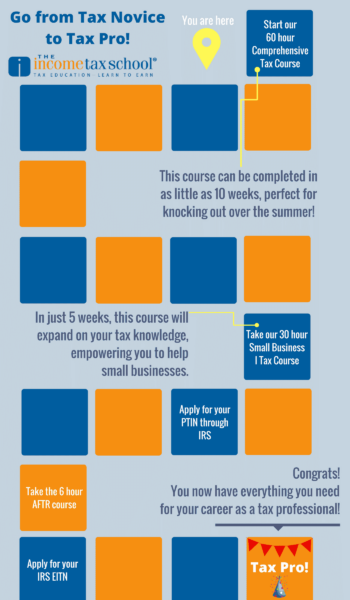

So many career paths today require years of schooling and are very expensive – leaving you burned out and in debt! A career as a tax preparer is possible in as little as 10-weeks by completing The Income Tax School’s online 60-hour Comprehensive Tax Course, which starts at just $497.

In addition, you don’t need to know accounting or high level math. You don’t even need a college degree! We teach you everything you need to know. The most important attributes for success as a tax preparer are the ability to read and comprehend the tax laws and excellent people skills. If you’ve got that going for you, you’re golden!

High Income Potential

As an experienced tax preparer working for someone else, you may earn $25 per hour or more, and self-employed tax professionals can earn more than $100 per hour. During the 3-month tax season (mid-January to mid-April) it’s possible for a self-employed tax preparer to earn $50,000 or more.

Year-round income opportunities also exist for tax preparers who provide taxpayer representation or related services such as small business bookkeeping, payroll and financial planning. In addition, the more tax knowledge you acquire, the more complicated returns you will be able to prepare, and the more income you can make!

Learn more about how to get started as a tax preparer today!

5. We offer Active Military and Veteran Discounts

Active Military Personnel and Veterans, as well as their spouses, save 20% on e-learning tax courses, seminars and certificate programs.

Not valid with any other offers. To qualify, please scan valid military ID and email or fax (1-877-787-1040) to The Income Tax School. Please call 1.800.984.1040 to register for discounted elearning tax courses or programs once valid ID has been received at The Income Tax School.

What are your waiting for? Get started on the fast track to a rewarding career as a tax professional today!

source http://www.theincometaxschool.com/blog/tax-preparation-career-military/

made (or trying to be made) that could have serious impacts on our roles as tax preparers and tax business owners. Here are 4 stories you should be aware of and following closely.

made (or trying to be made) that could have serious impacts on our roles as tax preparers and tax business owners. Here are 4 stories you should be aware of and following closely.