AI is the hot technology term these days. It seems to be “disrupting” just about every industry you can think of – including the tax industry. This past tax season, H&R Block partnered with IBM Watson to use its powerful AI capabilities in 10,000 of its U.S. offices. The initial focus of the technology was to help H&R Block preparers recommend deductions and credits to clients.

It begs the question: how far will AI go? Who’s to say companies like Turbo Tax won’t leverage the

The report also predicts that AI will be able to optimize the best outcome and course of action for large companies with lots of data. It can help by taking large sets of data like supply chain data, SKU level sales data, tax data, and external environment data and use it to optimize effective tax rates (ETR) and tax efficient profitabilities.

Does this mean it will replace human tax preparers? We don’t think so. AI can do a lot but here are some things it can’t do:

- Represent taxpayers in front of the IRS.

- Reassure taxpayers when they think all hope is lost.

- Answer the one million questions a taxpayer may have.

- Provide personalized customer service.

What you should be excited about

While Block seems to have the advantage right now, it doesn’t mean all hope is lost for smaller tax preparation firms. There’s actually a lot to be excited about.

First, think of the data and historical patterns that could be uncovered if the IRS was to adapt the technology? There’s a lot that could improve in terms of customer service and industry data.

PwC principal and tax technology and process leader Michael Shehab, “What has been missing in this industry for a long time, and what we’re really focused on, is not just delivering a tax return but delivering the analytics associated with the tax return. We’re trying to make the tax return preparation process more efficient, but we’re also trying to make it higher value added rather than simply delivering a tax return.”

Second, there’s a lot of time that could be saved with AI as your tax assistant. Categorizing and processing information that has different formats, statistical modeling, tax research, generating K-1 schedules, etc. Using AI to automate repetitive tasks could help tax preparers elevate themselves to do more reviewing rather than being bogged down with data and paperwork each season. This could have huge impacts at the corporate level when there’s a lot more data to deal with.

How to avoid being replaced by a robot

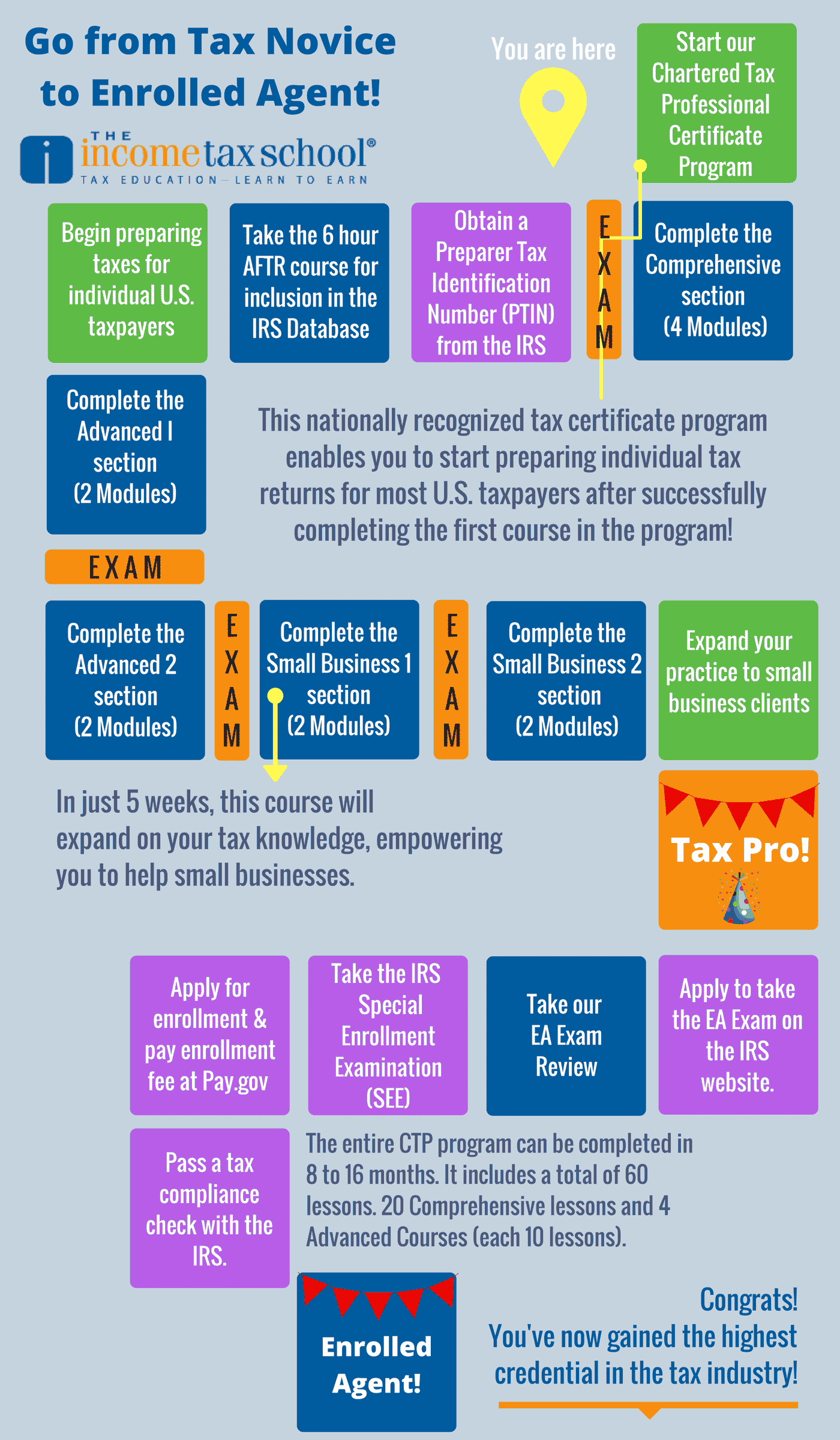

Tax preparers should really be looking to arm themselves with as much tax knowledge as possible. Competition is already steep when it comes to preparing taxes for the general public. You’re competing with tax software, national firms, and everyone else who “hangs a shingle”. But there will always be a need for Enrolled Agents, who have the highest designation in the industry and are the only industry professionals who have unlimited representation rights in front of the IRS. The more tax education you can get the better. When tax trouble comes knocking, taxpayers will always opt to do business with a person over a computer.

So how do you attain that knowledge? Our Chartered Tax Certificate Program is a clear path to Enrolled Agent. You’ll learn everything you need to know to prepare yourself for the SEE (Special Enrollment Exam). Here’s how it works:

source http://www.theincometaxschool.com/blog/what-does-the-use-of-ai-in-tax-preparation-mean-for-tax-preparers/

No comments:

Post a Comment